In the age of DIY (do it yourself) projects, consumers are starting to take that same mentality into their home-buying process, at least in the initial stages, new survey results from Chase found.

Chase’s report, “Insights from the Mind of the Modern Homebuyer,” used the findings of an online survey among a nationally representative sample of 1,014 adults (18 years old and older) living in the continental United States.

So what's changed? With the rise of digital and technology and the ‘always-on’ mentality, home-buying trends are shifting, the report stated.

According to the survey, 68% of Americans are starting the home search on their own, with 45% using a computer or laptop as the first step and 13% using their mobile device.

“With endless options and information at the consumer’s fingertips, it’s changing the way people look at major purchases decisions,” said Sean Grzebin, head of retail mortgage banking for Chase.

However, Grzebin added, “While homebuyers are using technology to find their next home, more than 70% still rely heavily on a mortgage professional.”

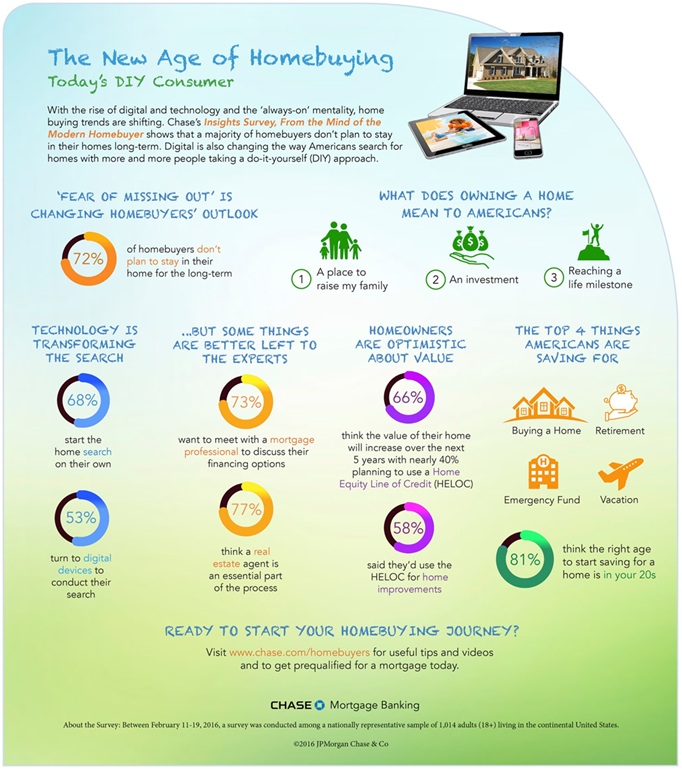

This infographic gives a full presentation of the survey result.

Click to enlarge

(Source: Chase)