A recent study analyzing mortgage requests for Millennials ages 18-34, showed that homeownership is rising in cities such as Boston, Pittsburgh and Washington, D.C., according to online lending exchange, LendingTree.

“The under-35 crowd had been, for some years, hesitant to enter the housing market, but we’re seeing that start to shift,” said Doug Lebda, CEO of LendingTree.

“The data all points to the fact that millennials are increasingly eager to own rather than rent, and even the incredibly high real estate prices in some markets don’t necessarily deter them,” added Lebda.

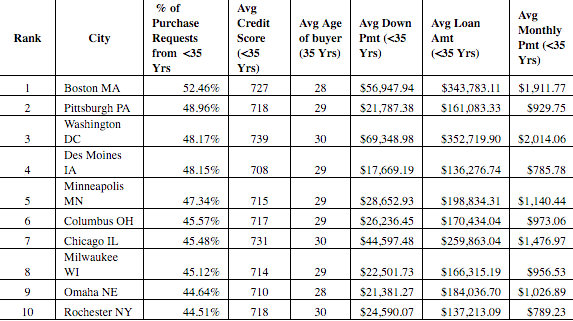

The latest LendingTree study shows that Boston topped the list with 52.5% of all purchase mortgage requests coming from millennials, followed by Pittsburgh at 48.96% and Washington, D.C. at 48.17%. Average mortgage loans to young borrowers in those cities are $343,783.11, $161,083.33 and $352,719.90 respectively.

Since San Francisco ranks No. 1 in the hottest housing markets for the spring homebuying season and is also known where top-earning professionals can afford expensive housing costs, millennials signed on for the highest average mortgage loans at $505,160 making it the biggest average down payments to be $162,474.

“Overall, we’ve seen a 28.5% increase in loan requests from millennials this past year over the prior one, evidence that the appeal of home ownership is strong – and growing- for young buyers,” said Lebda.

According to the study, due to its low mortgage payments at $748 a month, Millennials requesting mortgage loans in Buffalo, New York are currently the lowest at $131,232 with down payments averaging at $21,915.

A survey of 200 mortgage lending professionals showed that nearly tow in three mortgage lending professionals expect mortgage purchase production to increase, according to Lenders One Mortgage Barometer.

The overall anticipated increase for 2016 is set at 11%. In addition, 87% of mortgage professionals believe the mortgage purchase market will be somewhat to extremely active.

Recent data from the State of Hispanic Homeownership Report put out by the Hispanic Wealth Project and the National Association of Hispanic Real Estate Professionals reports that Hispanic Millennials are fueling population growth and homeownership demand among young adults.

Here are the top 10 cities attracting Millennials.

Click chart to enlarge