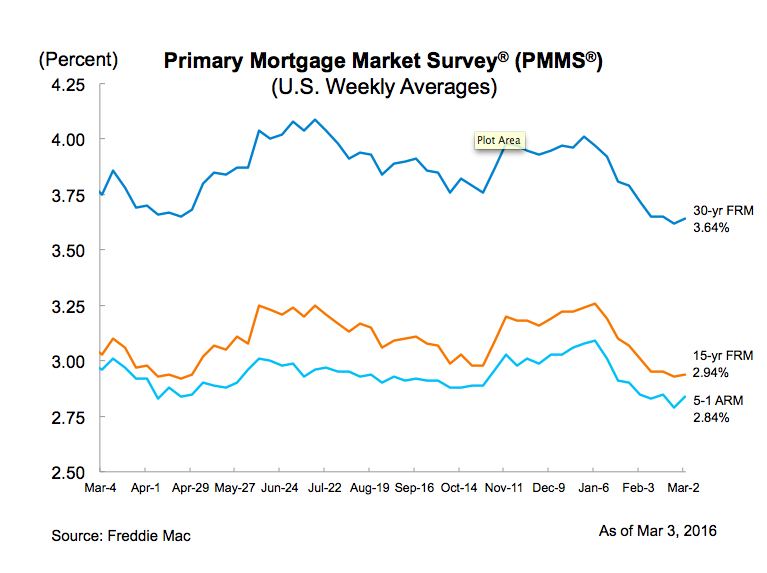

After trending lower for most of this year, mortgage rates finally reversed course and increased as market turmoil started to abate, the latest results of Freddie Mac’s Primary Mortgage Market Survey recorded.

The 30-year fixed-rate mortgage averaged 3.64% for the week ending March 3, up from last week when it averaged 3.62%. A year ago at this time, the 30-year FRM averaged 3.75%.

Also increasing, the 15-year FRM this week averaged 2.94%, up from last week when it averaged 2.93%. In 2015, the 15-year FRM averaged 3.03%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.84%, up from last week when it averaged 2.79%. For the same time a year ago, the 5-year ARM averaged 2.96%.

Click to enlarge

(Source: Freddie Mac)

“The market turbulence that kicked off the year subsided at the end of February, providing at least a temporary break in the flight to quality,” said Sean Becketti, chief economist with Freddie Mac.

Majority of the mortgage reports so far this year were impacted by market turmoil, as Treasury yields dropped to new lows.

In the latest report, Becketti said, “Treasury yields approached their highest level in a month, boosting the 30-year mortgage 2 basis points this week to 3.64 percent. Despite this welcome breather, Fed officials have been highlighting the downside risks to the economic outlook, and the market expects the Fed to refrain from any further short-term rate increases for now.”