#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;}

“Bank to pay million-dollar penalty!” in a bold font is too often the type of headline consumers read day in and day out. Mortgage lenders are consistently viewed as wrongdoers, instead of businesses that want to help consumers. Most lenders just want to do the right thing – provide consumers with mortgage loans in a business model that is both profitable, allowing it to operate, while legally compliant. For the past several years, mortgage lenders have had to work particularly hard to make a profit as they face continuous compliance challenges in adapting to an increasingly regulated environment.

Yet, instead of lenders being rewarded for such focus on compliance, which ultimately helps the consumer, the media message has been concentrated on lenders who have been penalized for regulatory violations. Changing an image is a challenge in any industry, so how can the mortgage industry help to change the message?

Industry Headline Woes

It is no surprise that after the housing market crash the media published stories concentrating on the acts of industry players that led to the crisis. A common sentiment that evolved from this among borrowers was that lenders were not to be trusted. That perspective remains, despite the fact that lenders have taken great steps to ensure that today’s lending environment is safer for borrowers than ever before. Marcia Davies, chief operating officer of the Mortgage Bankers Association, advocates that there is a need to “change the dialogue.” She cites several headlines that read:

- [Bank] reaches $7 billion deal with feds

- [Bank] and DOJ reach $17 billion settlement over mortgage securities

- Mortgage probes shift to smaller banks

- CFPB plows ahead with public consumer complaint database

As of Sept. 1, 2015, approximately 27% of the complaints received by the Consumer Financial Protection Bureau were related specifically to companies in the mortgage industry. Mortgage servicing issues experienced by consumers comprised 80% of these mortgage industry related complaints. About 14% of the 27% of complaints originated from interactions with mortgage companies prior to and during the loan-application process.

With over a quarter of the complaints to the CFPB related to the mortgage industry sector, it is not surprising that media outlets run rampant with negative stories about mortgage lenders. Building more customer satisfaction leading to less consumer complaints may be part of the solution of changing the message.

Building customer delight

As the United States emerges from the financial crisis, retail mortgage bankers are struggling to make the right changes in order to be both competitive and to keep up with unprecedented regulatory challenges and shifts in consumer behavior. In this way, the market is very adjustive. While some lenders are making regulatory headlines, other lenders watch, digest and adjust their practices.

Depending upon the company, imposed penalty, fine and regulatory violation, such events send shock waves throughout the industry as mortgage executives seek to make changes that balance cost, competition and effectiveness. As adjustments are made to operations, challenges arise regarding how to translate these changes into a sales advantage in measurable and meaningful ways.

The majority of lenders have a rudimentary and very basic understanding of measuring customer satisfaction. Most leverage survey functionality in their CRM software as their method of measurement, however they lack a consistent, systemic approach that measures customer satisfaction that effectively drives change from within their organization.

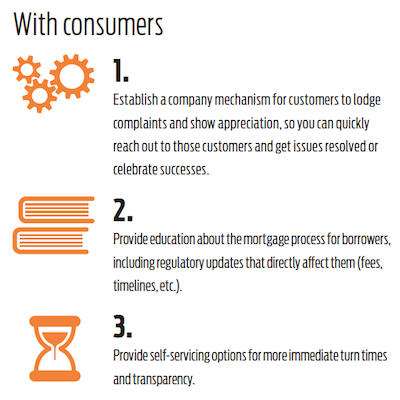

There are three important aspects to client measurement systems: a system to collect consumer complaints, a mechanism to express customer appreciation, and lastly, a formal connection between data collection and operational change. Michigan Mutual, a nonbank mortgage lender, is an example of a company which has implemented these aspects into the firm’s operations to achieve a higher degree of customer satisfaction, to the extent that the lender consistently achieves satisfaction levels that exceed 80% with response rates of 30% or more from consumers.

There are three important aspects to client measurement systems: a system to collect consumer complaints, a mechanism to express customer appreciation, and lastly, a formal connection between data collection and operational change. Michigan Mutual, a nonbank mortgage lender, is an example of a company which has implemented these aspects into the firm’s operations to achieve a higher degree of customer satisfaction, to the extent that the lender consistently achieves satisfaction levels that exceed 80% with response rates of 30% or more from consumers.

A recent title company advertisement read, “You don’t need a customer-complaint process when you have a customer delight process!” While this produces a catchy marketing slogan, changing the message revolves around modifying the relationship with the consumer, and this requires appreciating both the complaint and the response in order to yield “customer delight.”

Can the industry reconcile the need for the CFPB consumer compliant database through the establishment of customer delight? Customer delight is achieved by building relationships utilizing communication and education, which establish trust and consumer confidence.

Trust is one of the biggest hurdles lenders face in improving their image and relationships with consumers. To help establish this trust, transparency needs to be a top priority in lenders’ business practices. While a generous amount of information related to lending is made public through regulatory filings and financial reporting, lenders need to aid in raising awareness that this information is available and where it is located. Conveying such data to consumers may seem simple, but the affirmative steps of doing so are often overlooked.

#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;}

This proactive approach is particularly important when it comes to information regarding complaints levied against lenders and their reputation. Lenders have the opportunity to reach out to consumers to correct or address complaints prior to them being reported to the CFPB, as long as lenders create a scorecard and are cognizant of such complaints ahead of the regulatory agency. If lenders are not proactive, they are strictly at the mercy of consumers who utilize these statutes built to protect the consumer, including the CFPB consumer database.

Consumer choice and education are paramount to today’s mortgage banking operation. Lenders need to provide tools to allow borrowers to find the information they need about mortgage products and options available to them, and the entire lending process. Lenders should also take it upon themselves to discuss and educate consumers about regulatory updates as they affect their consumers.

An example of this is modifications to the mortgage process as a result of the recently publicized TILA-RESPA Integrated Disclosure forms. Lenders can take this opportunity to aid potential buyers in understanding TRID and how it will help them – particularly with understanding fees from the loan estimates to the closing disclosure. Educated borrowers are less likely to experience discomfort and anxiety as they move through the mortgage process, and it is much more probable for them to be invested in a partnership with a lender who cares enough to help them in what can seem like a daunting endeavor.

An example of this is modifications to the mortgage process as a result of the recently publicized TILA-RESPA Integrated Disclosure forms. Lenders can take this opportunity to aid potential buyers in understanding TRID and how it will help them – particularly with understanding fees from the loan estimates to the closing disclosure. Educated borrowers are less likely to experience discomfort and anxiety as they move through the mortgage process, and it is much more probable for them to be invested in a partnership with a lender who cares enough to help them in what can seem like a daunting endeavor.

Furthermore, lenders should have automated systems in place to collect data governing the consumer experience, and how they specifically gauge the effectiveness of existing sales and operational practices. Without specific metrics, automated methods for collection and a serious process discipline regarding improving consumer choice and education, a lender is left to whimsical methods that lack meaning and value to their organization.

Lenders can assist in fostering a positive relationship with borrowers by providing high quality customer service though open communication and ensuring clients that they have proper safeguards in place. This can be accomplished in financial institutions that have a customer-centric business model. This would include, for instance, having dedicated client liaisons to give a personal approach to consumers, helping to build trust, rapport and facilitation of understanding between the lender and consumer. Such consumer-centric models ideally implement compliance and quality control protocols to help ensure they are not violating any regulations or causing potential risks.

An example of such a business model is held by Digital Risk LLC, a global provider of mortgage-related services, which aims to help clients close loans faster while keeping customers informed during the process. If a customer expresses dissatisfaction during the loan fulfillment process, industry-leading business intelligence allows for identification, tracking and proactive resolution of the issue aimed at improving the customer experience.

Best practices in building consumer relationships can also be adopted from other industries. For example, in the student loan market, lenders improve borrower satisfaction by fostering communication strategies that focus on explaining and making sure borrowers understand loan terms, bill statements and repayment options.

Building consumer delight can also be achieved by enhancing the consumer experience through self-service technology, which allows for easy and interactive communication. The ability to interact with customers via technology is very common in many customer-facing industries, and the mortgage industry is now beginning to realize the importance of such self-service availability to the consumer.

More recently, borrowers are able to utilize lender platforms to compare rates and terms, apply for a loan, complete the mortgage application process, close the loan, review loan terms, assist with calculations and forecasting, obtain real-time loan status updates, make payments and create changes to their accounts. Providing web-based tools, portals and self-servicing options allows for a better customer experience, more immediate turnaround times and more transparency to build consumer trust.

#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;}

Compliance as an Opportunity

During the past several years, there is no question that there has been a significant change in the regulatory climate in the mortgage industry, resulting in high scrutiny by the overseeing agencies. Rather than viewing such compliance as a reason for penalties, lenders should see them as an opportunity to develop a deeper understanding and appreciation for the consumer. Compliance can require lenders to invest in new software and technology, take on tedious reporting, overhaul historical and customary practices and implement new policies and procedures. These acts, however, also allow an organization to review their processes and find areas that could eventually cause regulatory concern and consumer harm.

One example of a regulation that will require lenders to change their processes and make significant modifications is the CFPB’s Home Mortgage Disclosure Act, a new rule that provides for changes to be implemented to disclosure of data. Under HMDA, any financial institution generating 25 or more closed-end or reverse mortgages in a year will have to report HMDA data, and larger lenders will now need to submit data quarterly as opposed to the current practice of submitting data annually.

One example of a regulation that will require lenders to change their processes and make significant modifications is the CFPB’s Home Mortgage Disclosure Act, a new rule that provides for changes to be implemented to disclosure of data. Under HMDA, any financial institution generating 25 or more closed-end or reverse mortgages in a year will have to report HMDA data, and larger lenders will now need to submit data quarterly as opposed to the current practice of submitting data annually.

The underlining purpose of the new changes is transparency between consumers, regulatory agencies and mortgage lenders. The HMDA modifications to reporting requirements, while perhaps tedious in nature, will allow lenders to educate, disclose and promote transparency that, in turn, improves customer satisfaction as a reflection of enhanced trust between the consumer and lender.

Building Media Relationships

Lenders shouldn’t be quiet about the extra mile they are going to help consumers, and it is critical that a proactive approach is taken with the media. Their marketing campaigns need to highlight that they serve broad customer bases and are adapting to an ever-changing marketplace. Constant reporting of positive news by lenders should theoretically provide media outlets less fodder for negative stories, or at least begin to highlight their side of the story. While the media will continue to print salacious stories of lender wrongdoings, taking proactive steps, such as providing feedback on customer satisfaction, statistics, market diversity and success in fair lending, can aid the media in painting a new picture of lenders.

Lenders should use caution and choose words carefully when speaking out against regulations promulgated to protect consumers. If the underlying goal is to provide less negative ammunition for media outlets and improve the industry’s image, it is counterproductive for lenders to speak against those regulations protecting the consumers.

Public relations campaigns, coupled with developing relationships with reporters must not be overlooked by lender sales and media departments. Lenders ought to treat the press like potential clients and offer to share company thought leaders’ expertise, opinions, innovations and findings, as well as important milestones in their businesses. If a reporter has a direct dial, email or text to a face at the company, there may be a higher chance that the reporter will seek to, at the very least, hear a counterargument to that which may be voiced by the consumer or a regulatory agency. Notwithstanding, the media thrives on sensational stories, thus this is clearly not an easy task and it is one that will take time to achieve.

Seven years after the 2008 housing market crash, media outlets continue to paint pictures highlighting lenders’ non-compliance and focusing on consumer horror stories. The constant spotlight shining on mortgage companies’ regulatory non-compliance leads to the question of how lenders can change their image during times when the media is quick to chastise those lenders facing regulatory scrutiny. By enhancing customer delight, serving a broad base of consumers and having less compliance-related horror stories upon which the media can focus, lenders can work toward changing the message. Perhaps in time the headlines will read, “Banks help consumers find homes and reach the American dream!”