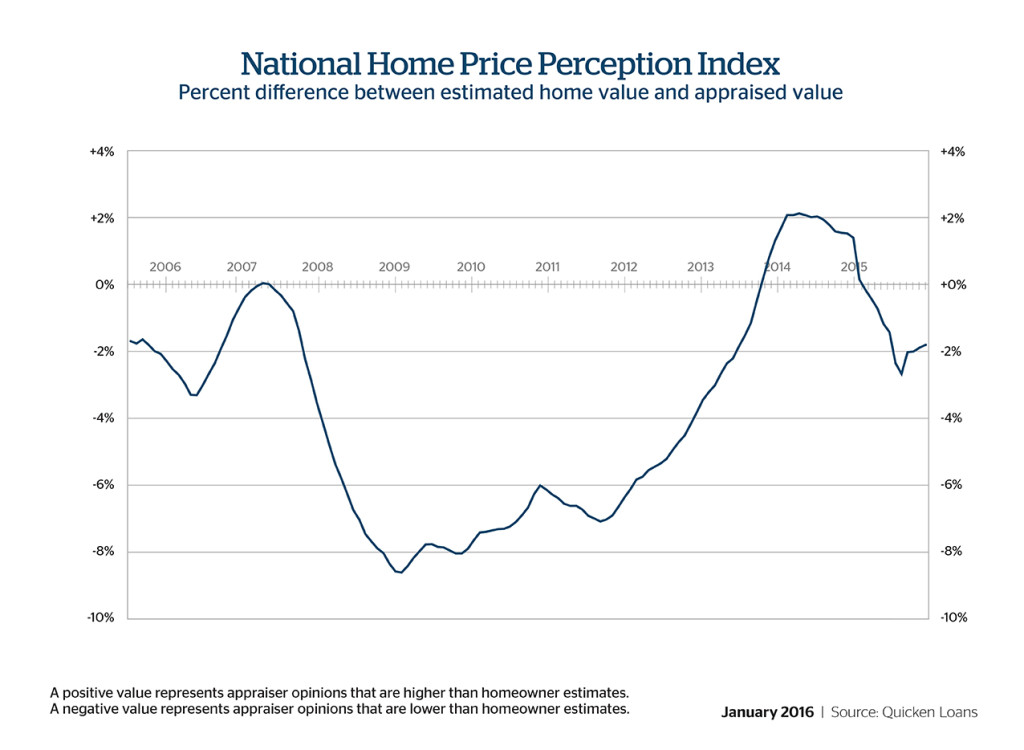

Quicken Loans announced the average appraised values in December were 1.8% lower than what homeowners’ valued their home. But, according to Quicken, this is good news.

According to its monthly Home Price Perception Index, December is the 11th straight month when appraised values were lower than homeowners expected, although December marks the fourth month the gap between the two values have narrowed.

The nation's second-largest mortgage nonbank lender, the Quicken Loans’ HPPI chart below shows many of the metro area's value perceptions moving closer to equal. Appraisals remained higher in Western cities, while homeowner expectations topped appraised values in many of the Northeastern and Midwestern cities examined.

Click to enlarge

“The narrowing of the perceived vs. appraisal value gap is an excellent way to end the year,” said Quicken Loans Chief Economist Bob Walters.

“The more homeowners are in line with appraisers, and understand the equity in their home, the easier it will be to refinance their mortgage. In the same vein, if homebuyers understand how the local market is performing, they will be better equipped to come in with a strong offer on the home of their dreams,” added Walters.

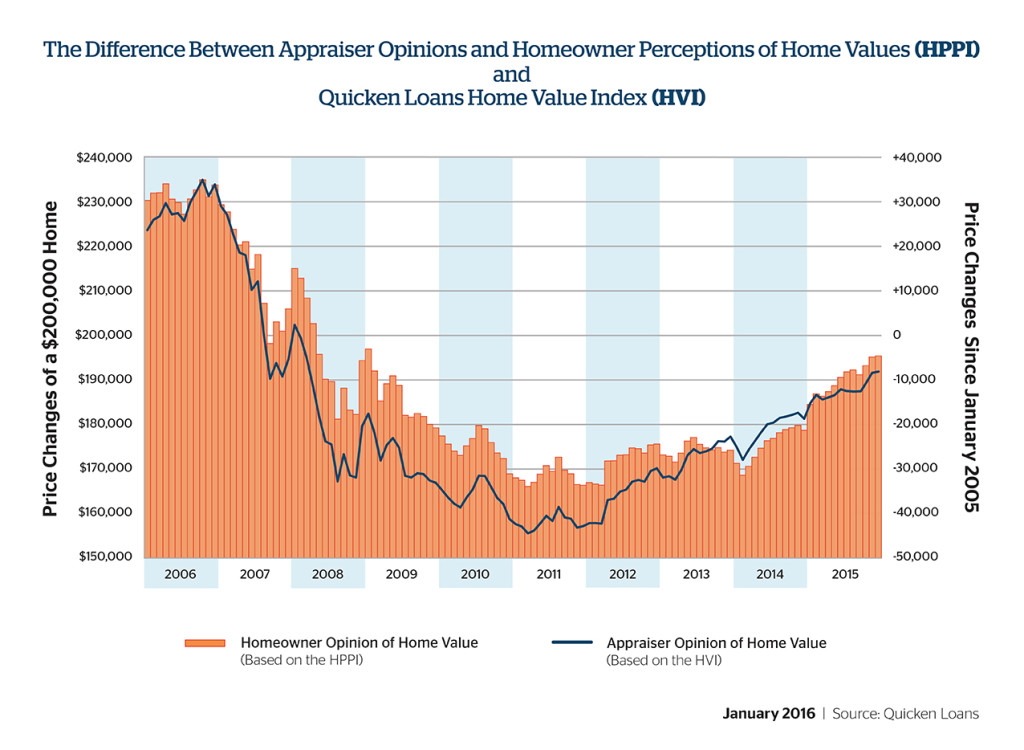

Per the home value index, home values rose 0.18% from November to December, and increased 5.81% compared to the previous December. While the West remains the leader with 8.61% in annual home value growth since December 2014, the Northeast dwindles with only a 1.87% increase.

Click to enlarge

“2015 bookends with the same story we have heard throughout the year – a housing supply that trails the demand, continuing to push values higher,” said Walters. “The market could benefit from homeowners taking advantage of the equity they are building, and make their home available to the many eager buyers. This could give buyers a chance to find the home they have been waiting for.”