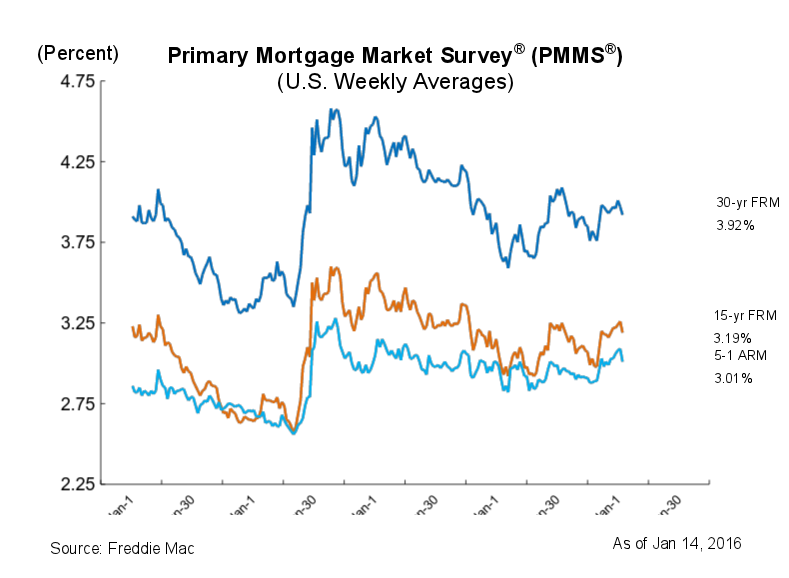

Mortgage rates managed to stay below the 4% threshold for another week, according to the latest Freddie Mac Primary Mortgage Market Survey.

Two weeks ago was the first time in five months that the 30-year mortgage rose above 4%, but it didn’t linger that high for long. Last week, the 30-year mortgage dropped back down for the start of 2016 as concerns about overseas economic developments dominated the financial markets.

This week brought similar news, according to Sean Becketti, chief economist with Freddie Mac.

“Long-term Treasury yields continue to drop, dragging mortgage rates down with them. Turbulence in overseas financial markets is generating a flight-to-quality which benefits U.S. Treasury securities,” said Becketti. “In addition, sagging oil prices are capping inflation expectations. The net effect on the 30-year mortgage rate was a 5 basis point drop to 3.92%.”

For the week ending Jan. 14, the 30-year fixed-rate mortgage averaged 3.92%, down from last week when it averaged 3.97%. However, this is higher than a year ago at this time when the 30-year FRM averaged 3.66%.

The 15-year FRM this week dropped from 3.26% to 3.19%. A year ago at this time, the 15-year FRM averaged 2.98%.

In addition, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.01%, down from last week when it averaged 3.09 percent. In 2015, the 5-year ARM averaged 2.90%.

Click to enlarge

(Source: Freddie Mac)