Although mortgage applications significantly tumbled this week, the Federal Reserve’s recent interest rate hike is not to blame, according to a new report from Capital Economics.

Capital Economics originally forecasted back in December that the housing market could withstand a rate hike, with this new Mortgage Bankers Association report giving early evidence that it was right.

The results for the final two weeks of the year include an adjustment to account for the New Year’s Day holiday, while the previous week’s results were adjusted for the Christmas holiday. Last week is the only week of the year that the MBA doesn’t release a mortgage application report.

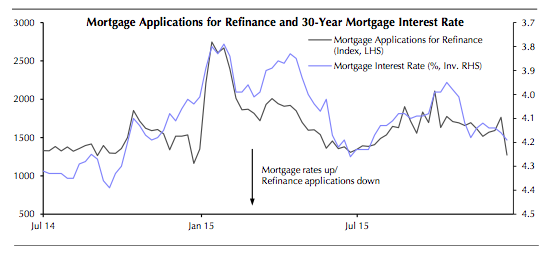

“It is tempting to ascribe that collapse to the decision by the Fed to increase interest rates for the first time in nine years at their December meeting. After all, there is a tight relationship between mortgage interest rates and refinance activity,” said Matthew Pointon, property economist with Capital Economics.

“But that is hard to square with the data. The rate hike was widely expected and as such the rise in mortgage interest rates has been relatively subdued – they increased from 4.14% at the start of December to 4.19% by the end. While that would be expected to lead to some contraction in refinancing, the drop is far larger than usual,” said Pointon.

As a whole, Capital Economics explained that total mortgage applications contracted for the second month in a row in December, recording a marginal decline of 0.7% m/m.

However, there is a substantial difference between applications for home purchase and refinance.

The report noted that after looking at the numbers broken up, the drop was caused entirely by a 6.3% m/m fall in refinancing activity – a similar sized contraction to that seen in November.

“That may reflect homeowners reacting to news of the hike, rather than actual changes to rates. However, we suspect that seasonal factors are also playing a role. While the MBA states there is no seasonal pattern, it is notable that the last time refinance applications dropped by such a large amount was also in the last week of the year,” said Pointon.

Applications for refinance had been rising up to the final week of the year, when they contracted by 28% – the largest week-on-week drop since the end of 2009, Capital Economics said.

Click to enlarge

(Source: Capital Economics)

Once refinance applications are taken out of the mix, applications for home purchases, which is a better indicator of underlying housing demand, increased by a substantial 10.5% m/m. This marks its highest level since early 2010.

“And they also held up in the final week of the year. That provides early evidence that housing demand will be able to withstand a rise in interest rates, thanks to an improving labor market and easing credit conditions. So while low inventory levels will constrain mortgage lending to some extent, a gradual rise in applications for home purchase can be expected this year,” said Pointon.