The PACE (Property Assessed Clean Energy) programs are designed to give homeowners new ways to finance energy efficient home improvements.

These programs, approved in 31 states, have been very controversial and the market has been slow to develop because of FHFA regulatory concerns over the issue of lien priority.

Under current rules, PACE assessments are billed with property taxes, and generally have a lien priority on par with tax liens and above the liens on first mortgages.

This has been resulted in a reluctance of the GSEs and the FHA to purchase or insure mortgages on properties with a PACE loan. In 2010, FHFA expressly directed the GSEs not to purchase mortgages affected by first lien PACE obligations; but never followed up with a formal rule.

The FHA has been largely silent on the issue of insuring mortgages with PACE loans, and has, until recently, not sought to develop a consistent approach. In August of 2015, FHA issued a statement that it will make financing available for single family homes with subordinated PACE loans, subject to certain conditions, which have not yet been announced.

We believe that if the market for PACE improvements is to develop, the PACE lien must be subordinated, in line with recent FHA statements.

This leaves a critical design question which our research study attempted to address: if a home moving to foreclosure utilizes the core PACE approach of having the assessment (in this case subordinated) travel with the property (as all tax assessments do), would the GSEs and FHA be worse off than a similarly situated home which had no PACE improvement or assessment, because it would realize a potentially lower sale value?

Using a number of methodologies, we find that homes with subordinate PACE financing that travels with the property provide collateral for FHA and GSE loans that is at least as strong and indeed likely stronger than properties without PACE improvements.

Data

The only state that has developed a large PACE loan program is California: the largest PACE participant is Renovate America, with a 90% share of the California market. This research study examines data on the 773 homes that financed a renovation in California through the program offered by Renovate America, where the home was subsequently resold. The average purchase price was $236,324, the average sale price was $342,577, and the average adjusted sale price was $331,890 (accounting for the homes where the sales proceeds were used to pay off the assessment). All homes in the sample were resold between 2012 and 2015.

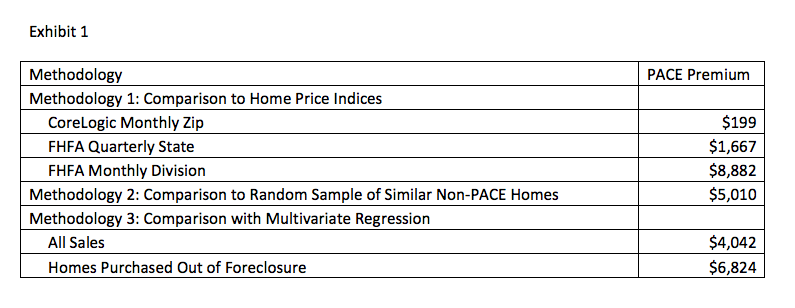

We compared the actual value of the 773 homes (adjusted downward for any PACE balance payoffs) to the resale value of similarly situated non-PACE homes. We used three different methodologies for this study to ensure robustness; our results consistently showed that PACE homes sold at a price of $199 to $8,882 over comparable non-PACE homes after taking into account the financing costs of the project. This study differs from previous studies in two respects: it is the first study to look at the data of actual homes that have deployed PACE, then subsequently sold; and second it is the first study to determine not just whether the energy renovations added value to a home, but whether the value of the home energy renovation exceeds or falls short of its financing cost.

Methodology and Results

Methodology #1: Compare the actual adjusted resale price for homes with PACE loans to the projected market value based on the CoreLogic zip code level Home Price Index, the FHFA state level index (California) and the FHFA division level index (Pacific Census Division, includes California, Washington, Oregon, Alaska and Hawaii)

The Results: PACE homes sold at a $199 premium using the CoreLogic Monthly HPI, $1,667 using the FHFA state index and $8,882 using the FHFA division level index (Exhibit).

Methodology #2: We matched each loan in the sample to a random non-PACE loan in the CoreLogic property database with the same zip code, purchase year and sale year. We then compared the purchase and adjusted sale price of the PACE homes to our non-PACE sample.

The Results: We found the average purchase price of the PACE homes was $1,591 cheaper than the non-PACE sample, the average adjusted sale price of the PACE homes was $3,419 higher, for a total difference of $5,010 which is statistically significant.

Methodology #3: We pooled loans with PACE improvements and our matched sample of loans without PACE improvements, and ran a multivariate regression analysis. The dependent variable was resale price, the independent variable includes purchase price, square feet of living space, number of baths and whether or not the property had a PACE loan. In some regressions, we included a variable to indicate whether the home was purchased from foreclosure.

The Results: A PACE improvement will increase home resale value by $4,042. If the PACE home was purchased from foreclosure, the increase was $6,824.

These results are summarized in the Exhibit.

Click to enlarge

Summary and Discussion

Thus, we see that regardless of the methodology used, the PACE premiums, after taking into account financing costs, ranged from $199 to $8,882. That is, the homeowner recovered more than their investment. By contrast, in most other improvements such as kitchen and bathroom remodeling, recent studies show the homeowner recovers only 60% or so.

And these results may actually understate the value of the PACE improvements upon resale:

- Many homeowners opt for an improvement when the original equipment breaks. If the improvements did not occur, the home value may well have been lower.

- Energy efficient improvements are a relatively recent phenomenon. Home buyers may be reluctant to fully capitalize into prices the present discounted value of lower energy costs, as they are unsure how long the improvement will last. Over time, we may see higher capitalization rates.

In conclusion, we find that homes with subordinate PACE financing that travels with the property provide collateral for FHA and GSE loans that is at least as strong as properties without PACE improvements.

Laurie Goodman is the Director of the Housing Finance Policy Center at the Urban Institute and Jun Zhu is a Senior Financial Methodologist at the same institution. However this report/presentation was funded by Renovate America, and is not a product of the Urban Institute. The views expressed are those of the authors and should not be attributed to the Urban Institute, its trustees, or its funders.