The average 30-year fixed mortgage rate inched higher due to a better than expected November employment report, according to Freddie Mac’s Primary Mortgage Market Survey.

According to the most recent jobs report, job creation increased by 211,000 in November, giving the final confirmation that the Fed will likely raise rates this month, the Bureau of Labor Statistics said.

“November jobs report continues to show an upbeat picture of the labor market. A solid job gain of 211,000 following sizable upward revisions in the prior two months boosted the average job gain over the past three months to a respectable 218,000, the best showing since July,” said Doug Duncan, chief economist with Fannie Mae.

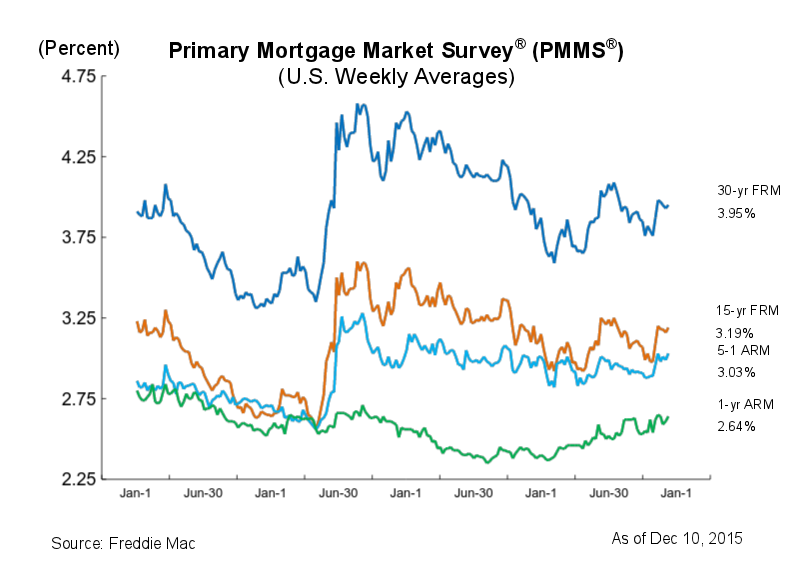

Click to enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 3.95% for the week ending Dec. 10, up from 3.93% last week. A year ago at this time, the 30-year FRM sat at 3.93%.

Similarly, the 15-year FRM this week averaged 3.19%, up from last week when it averaged 3.16%. In 2014, the 15-year FRM averaged 3.20%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage came in at 3.03%, increasing from 2.99% the previous week. A year ago, the 5-year ARM averaged 2.98%.

The 1-year Treasury-indexed ARM averaged 2.64%, up from 2.61% last week. At this time last year, the 1-year ARM averaged 2.40%.

“The economy added 211,000 new jobs in November exceeding analysts’ expectations, and the prior two months were revised higher as well. This momentum is likely to cement a decision by the Fed to begin raising interest rates this month. Following the release of the employment report, Treasuries rose 7 basis points and in response the 30-year mortgage rate ticked up two basis points to 3.95%,” said Sean Becketti, chief economist with Freddie Mac.