You won’t hear the words mortgage and music used in the same sentence very often, but with everything going on in the lending industry right now, the two have more overlap than usual.

Let me explain.

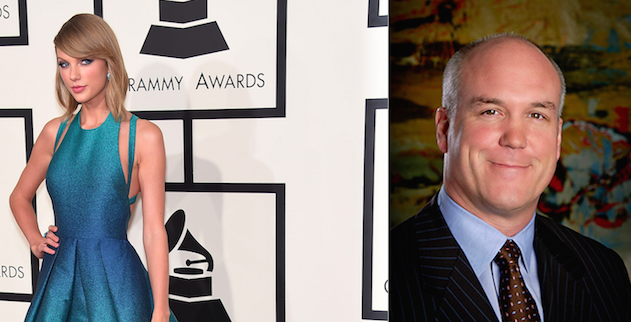

A little over a year ago, Taylor Swift shocked the music industry when she announced that she was pulling her music from Spotify, a free music streaming service that allows users to listen and create playlists from millions of tracks. The service also allows users to pay around $10 a month to eliminate ads and listen anywhere on the go.

This article in TIME explains how artists get paid on Spotify.

So how much do Spotify artists actually make? Artists earn on average less than one cent per play, between $0.006 and $0.0084, to be exact, according to Spotify Artists, a website that explains the service to artists.

It’s a small per-stream royalty, but for someone like Swift, a one-cent-per-stream model would likely rack in millions. Spotify has said that an unnamed but real-life artist was earning $425,000 per month in royalties for a “global hit album,” a category likely containing 1989, which is on track to set a record for the best-selling week ever for an album by a female artist. Additionally, over 70% of Spotify’s revenue goes to rights holders like the record label, publisher and distributor.

The crux of Swift’s decision comes down her passion and dedication to music.

Here is an excerpt from a blog Swift published in The Wall Street Journal:

There are many (many) people who predict the downfall of music sales and the irrelevancy of the album as an economic entity. I am not one of them. In my opinion, the value of an album is, and will continue to be, based on the amount of heart and soul an artist has bled into a body of work, and the financial value that artists (and their labels) place on their music when it goes out into the marketplace. Piracy, file sharing and streaming have shrunk the numbers of paid album sales drastically, and every artist has handled this blow differently.

Music is art, and art is important and rare. Important, rare things are valuable. Valuable things should be paid for. It's my opinion that music should not be free, and my prediction is that individual artists and their labels will someday decide what an album's price point is. I hope they don't underestimate themselves or undervalue their art.

Now let’s switch back to the mortgage industry.

On Wednesday, Quicken Loans, which is currently the largest Federal Housing Administration lender, said it is considering ending its participation in FHA lending entirely, citing the government’s aggressive enforcement policies as the main reason for potentially dropping FHA lending.

The issue goes back to a contentious legal battle between Quicken Loans and the Department of Justice over the DOJ’s allegations that Quicken violated the False Claims Act by “knowingly” submitting hundreds of “improperly underwritten” loans insured by the FHA.

Quicken Loans said it simply would not admit to this.

“We did not commit fraud against the government and we’re not going to cave to the DOJ’s demands and falsely claim that,” said Quicken Loans’ CEO Bill Emerson.

“It’s beyond comprehension why we would not stand up and fight when we know we’re right,” Emerson said. “That’s exactly why we filed the case. We’ve been very clear on where we are. We are the largest FHA lender and the highest quality lender by FHA’s own objective measurements standards.”

Does that passionate appeal to the quality and value of their work sound familiar?

Both Quicken Loans and Taylor Swift not only dominate in their respective industries, they both have a lot of fans.

For the sixth year in a row, Quicken Loans ranked highest in customer service for mortgage originators, according to the J.D. Power 2014 U.S. Primary Mortgage Origination Satisfaction Study.

Not only did Quicken Loans rank highest, but it ranked first in all six key categories of the study, including: interaction, loan closing, application/approvals process, loan offerings, onboarding and problem resolution.

And as far as Swift's popularity goes, when Spotify announced that Swift pulled her music, they added that of their more than 40 million users – nearly 16 million of them have played her songs in the last 30 days, and she’s on over 19 million playlists.

Other famous names on both sides have also joined these two.

More recently, Adele also refused to make her newest album “25” available for streaming. And as a result, the album has sold 3.38 million copies and counting, an article in Fortune said.

As for other lenders, John Shrewsberry, Wells Fargo’s (WFC) chief financial officer, recently said that the San Francisco bank will not make loans to FHA borrowers with low credit scores because of their higher rates of default.

In addition, Kevin Watters, CEO of Chase Mortgage Banking, said in an interview with CNBC that the FHA's loan requirements look an awful lot like subprime lending.

"FHA requirements are down to a 520 FICO (credit score) and you only have to put 3.5% down; that's subprime lending, and we're not in the subprime lending business," CNBC quotes Watters saying.

Now Quicken Loans, Wells Fargo, JPMorgan, Adele and Taylor Swift are all power-packed, famous names.

The article in Fortune asked the question: “Should musicians not named Adele (or Taylor) stop streaming?”

Here’s the article’s response:

Some may see Adele’s record-breaking sales as proof that putting songs on streaming services leads to less money for musicians. In other word, why stream when you can sell instead? The reality, though, is that Adele commands a special type of star power that lets her define the music market on her own terms. Besides Adele and Taylor Swift, who else is in this category? It’s hard to think of anyone else who could pull this off.

For everyone else, the best model may be that of Perrin Lamb, an independent singer-songwriter. As The New York Times explained in a feature, the streaming service Spotify brought Lamb $40,000 last year and helped him find a broad and diverse audience he might never have attracted otherwise. For such musicians stopping streams for the sake of sales could amount to cutting off their nose to spite their face.

Just as Taylor Swift and Adele have enough star power to stop streaming, Quicken Loans and the other top lenders are some of the few that can afford to pull back from FHA lending and fight back on what they view as wrong.

I don’t think this will be the end of top lenders doing FHA loans, and I don’t think the music streaming industry is going away. Instead, both parties are using the power they have that few others do to make an important point and maybe even bring about change.

As for whether it will work or not, well, it did for Taylor Swift.

On June 21, Swift wrote an open letter to Apple and its CEO, Tim Cook.

For background, Apple launched Apple Music in June, and the concept is comparable to Spotify. Check this article from TIME for more detail on it.

Here’s a brief clip from the letter Swift wrote:

To Apple, Love Taylor

I write this to explain why I’ll be holding back my album, 1989, from the new streaming service, Apple Music. I feel this deserves an explanation because Apple has been and will continue to be one of my best partners in selling music and creating ways for me to connect with my fans. I respect the company and the truly ingenious minds that have created a legacy based on innovation and pushing the right boundaries.

This clip from another TIME article summarizes the game-changing event best.

So in one of the most amazing changes of direction I’ve seen in my 35 years of watching Apple, Swift’s letter — and the public show of support it drummed up — got Apple to change its mind. Just hours after the note went up, Apple announced it would indeed be paying artists for their music during the free period, if at a reduced rate (other streaming services have similar practices).

You might think Swift’s Apple-shaming would be a public relations disaster for the company — and at first, this is how it was portrayed in the media. But in an ironic twist, Swift’s move was wonderful for Apple and its new music service.

In a surprising turn of events, it was a win-win for both parties, since millions more potential users are now aware of the service thanks to Swift.

This still leaves the question on whether or not the mortgage industry can see the same type of success from sticking up for itself with regulators.

In the best situation possible, maybe lenders and the FHA can both win in the end.

If nothing changes, Mortgage Bankers Association President and CEO David Stevens recently said that there are lenders that have already pulled back from FHA loans or may do the same.

Ultimately, Stevens said, “The underlying concern that I have around all of this is that this FHA program is the entry point for homeownership for Hispanics, African Americans and first-time homebuyers."

"The impact of unclear rules from the FHA combined with the Department of Justice using the false claims act as an enforcement vehicle is a whole new world for this program that was made to create access to credit," he said.

It’s not every day that a musical artist stands up to a company like Apple, and gets that company to change its mind, and it’s not every day that a mortgage lender sues the government.

Whether HUD and the DOJ will get the message is still to be determined.