Freddie Mac announced Wednesday that it completed its eighth Structured Agency Credit Risk Series credit risk-sharing deal of 2015, and announced that it plans to offer eight more STACR deals in 2016.

Freddie Mac’s eighth STACR deal of this year was its second risk-sharing deal that featured the actual-loss position on loans with loan-to-value ratios ranging from 80% to 95% earlier this year.

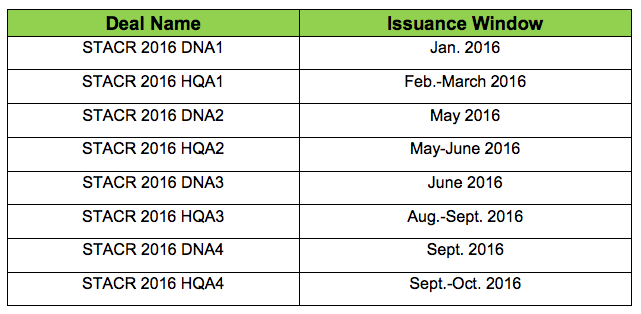

The higher LTV offering was part of Freddie Mac’s HQA series. Freddie Mac said in its announcement that it plans to offer four high-LTV STACR deals as part of its HQA series in 2016.

Freddie Mac also said that it will offer four STACR deals featuring the actual-loss position in 2016 as part of its DNA series.

"The issuance calendar is the next step in our efforts to be clear and transparent in our credit risk transfer offerings," said Freddie Mac Vice President of Credit Risk Transfer Mike Reynolds. "The STACR program has grown from two issuances in its first year to eight this year. We expect to have eight STACR transactions in 2016, and the calendar is intended to help investors plan their allocations."

Click the image below to see the 2016 STACR issuance calendar from Freddie Mac.

According to a release from Freddie Mac, it has now completed 17 STACR offerings, as well as two Whole Loan Security offerings and 12 Agency Credit Insurance Structure transactions since mid-2013.

Through STACR, WLS and ACIS, Freddie Mac has transferred a substantial portion of credit risk on more than $385 billion of unpaid principal balance in single-family mortgages, the government-sponsored enterprise said, adding that its various risk-sharing deal structures have attracted approximately 190 unique investors, including reinsurers.

As part of the announcement, Freddie Mac also released the pricing for its final STACR deal of 2015, STACR 2015-HQA2.

In previous announcements, Freddie Mac said that the $590 million STACR 2015-HQA2 has a reference pool of single-family mortgages with an unpaid principal balance of more than $17 billion.

The reference pool consists of a subset of 30-year fixed-rate single-family mortgages acquired by Freddie Mac between Dec. 1, 2014, and March 31, 2015, with LTVs from 80 to 95%, Freddie Mac said.

In the STACR 2015-HQA2 offering, Freddie Mac holds the senior loss risk in the capital structure and a portion of the risk in the Class M-1, M-2 and M-3, and the first loss Class B tranche.

Freddie Mac said that the pricing of STACR Series 2015-HQA2 was:

- M-1 class was one-month LIBOR plus a spread of 115 basis points

- M-2 class was one-month LIBOR plus a spread of 280 basis points

- M-3 class was one-month LIBOR plus a spread of 480 basis points

- B class was one-month LIBOR plus a spread of 1050 basis points

Citigroup and Barclays served as co-lead managers and joint bookrunners. BNP Paribas, Bank of America Merrill Lynch, Cantor Fitzgerald and Nomura were co-managers. Loop Capital was a selling group member.