The national credit score improved by three points over the last year, and by five points since 2013, with the 10 cities with the highest credit scores in the nation increasing their scores by an average of 1.8 points, the latest Experian annual State of Credit study found.

“If I were to give a grade to the overall picture of credit in the United States, I would give it an A minus. I’m optimistic about the state of credit as we are seeing more loans being extended, late payments are decreasing and consumers are continuing to gain more confidence in originating loans,” said Michele Raneri, vice president of analytics and new business development, Experian.

“There definitely is growth and momentum — we’re back to prerecession levels in nearly every category, which means lenders are in a prime position to capitalize on this market and foster business growth,” added Raneri.

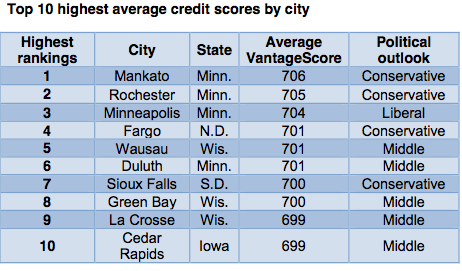

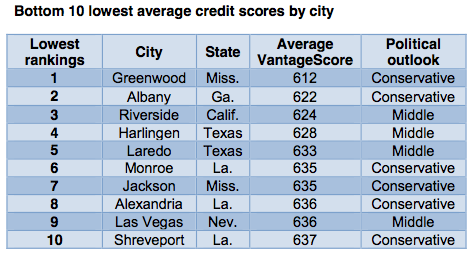

Experian generated a list of the top 10 highest average credit scores by city, along with the bottom 10 lowest average credit scores by city.

The list was compiled by looking at more than 100 metropolitan statistical areas (MSAs) across the country.

Unlike previous reports, this one provides insight into how residents of these top and bottom MSAs identify politically.

Here is the official list of the top 10 highest average credit scores by city and the bottom 10 lowest average credit scores by city.

Click to enlarge

(Source: Experian)

Click to enlarge

(Source: Experian)

For added political coverage, here's everything the Democrats said about housing in Saturday's debate and everything the GOP candidates said about housing in the fourth debate.