Since only a little over month has passed since TRID took effect, its impact on the market is still hard to measure.

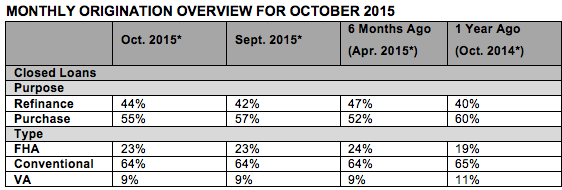

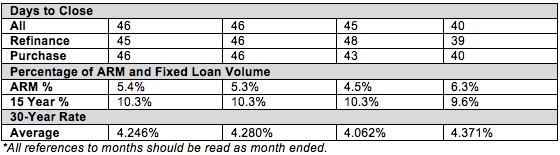

According to the most recent Origination Insight Report by Ellie Mae, TRID has yet to significantly dent the origination process.

“It is still too early to see if there will be impacts stemming from the Know Before You Owe changes that went into effect just last month,” said Jonathan Corr, president and CEO of Ellie Mae.

“The time to close loans remained a constant 46 days for yet another month, while the closing rate on purchased loans has stayed above 70%. We may begin to see time to close increase in the November data as the new closing disclosures are utilized for the first time,” Corr said.

It’s important to note that official TRID loans have made their way through the origination process. One of the first companies was Charlotte-based Movement Mortgage, which successfully closed its first post-TRID loan with no interruptions in mid-October.

"We are confident that these new regulations will only encourage others in the industry to do what we at Movement Mortgage have always advised our borrowers to do – Know before you owe by having a loan fully underwritten up front before the consumer begins shopping for a home," said Casey Crawford, CEO of Movement Mortgage.

Instead, Ellie Mae's report noted that credit scores on closed loans dropped to their lowest levels since Ellie Mae began reporting data in August 2011. The average FICO score on all closed loans fell to 722, marking the fifth consecutive month of decline.

The Origination Insight Report pulls data from a sampling of approximately 66% of all mortgage applications that are initiated through Ellie Mae's Encompass.

Click to enlarge

(Source: Ellie Mae)

Meanwhile, TRID has already left its mark in other parts of the industry, one of the most noteworthy being mortgage applications, which experienced a volatile month of upswings and downswings due to TRID.

Headlines from the results of the survey over the month include: “Mortgage applications skyrocket more than 25%;” compared to one week later: “Mortgage applications tumble more than 25% due to TRID.”