Mortgage credit availability continued its upward trend and increased in October thanks to new conforming loan programs, the most recent Mortgage Credit Availability Index report from the Mortgage Bankers Association found.

The report analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

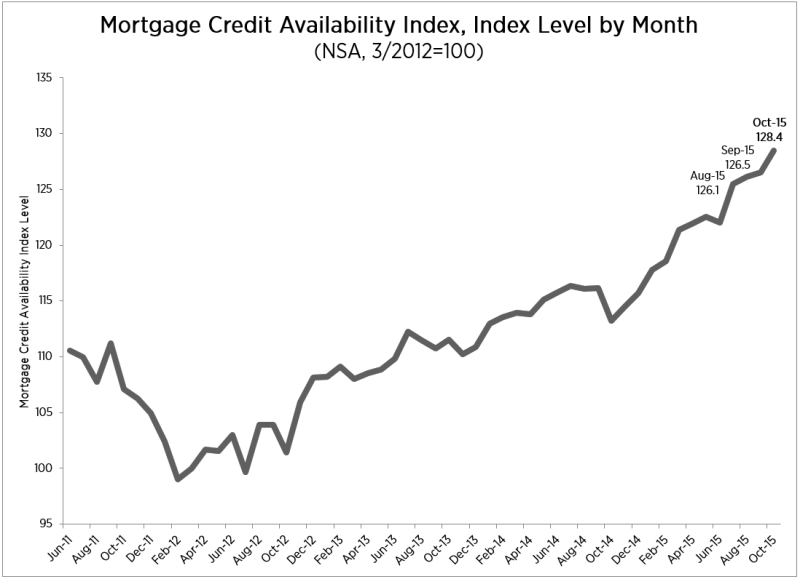

The MCAI jumped 1.5% to 128.4 in October, compared to a 0.3% increase to 126.5 in September. The measure ticked up in August, after recovering in July following a stall-out in June.

Click to enlarge

(Source: MBA)

Mike Fratantoni, MBA’s chief economist, explained that many of the new conforming loan programs were affordable housing programs, which have lower down payment requirements.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

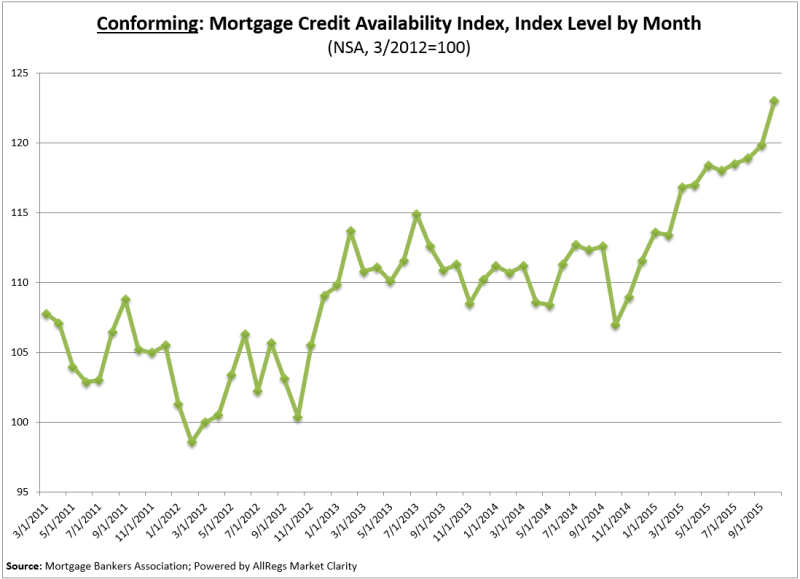

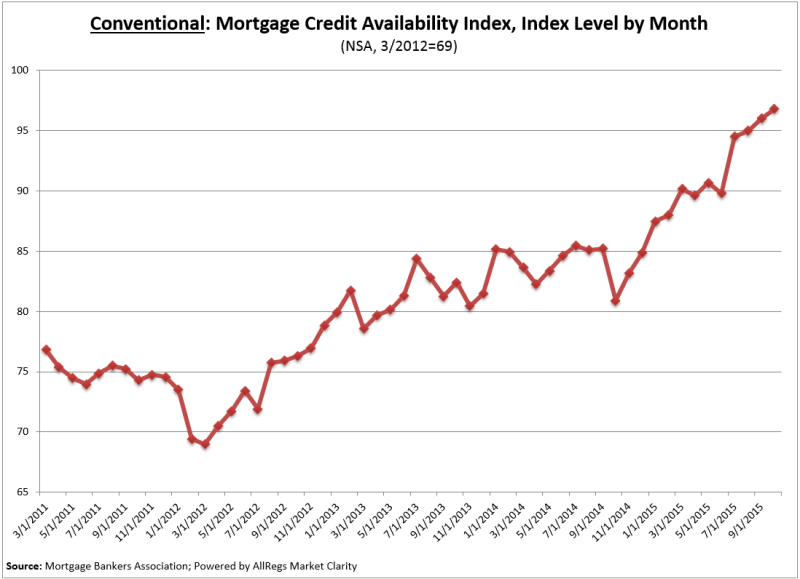

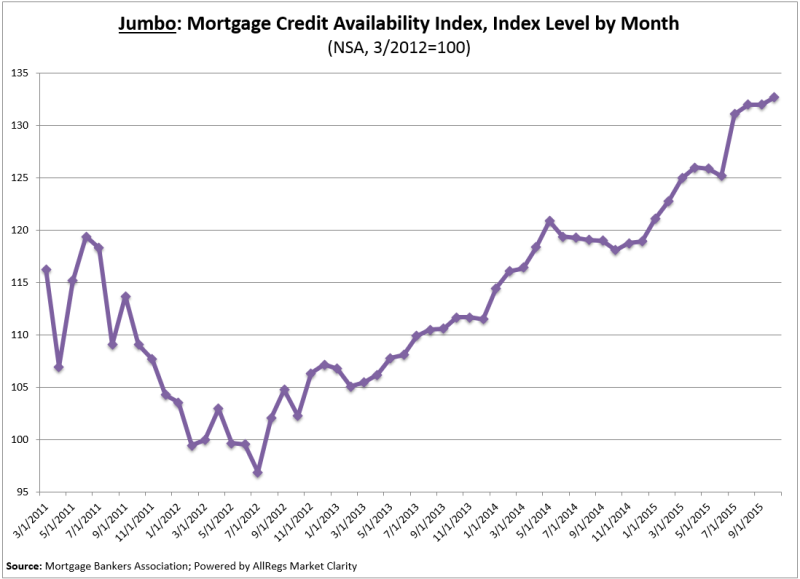

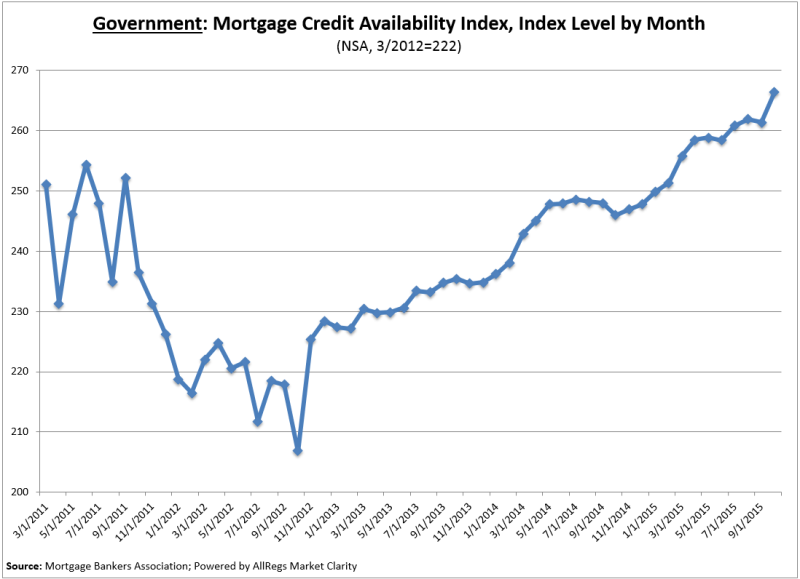

Broken up, the Conforming MCAI saw the greatest loosening out of the four component indices, increasing 2.7% over the month. This was followed by the Government MCAI, which was up 1.9%, the Conventional MCAI, which was up 0.8%, and the Jumbo MCAI, which was up 0.5%.

Here are four charts showing the four component indices.

Click to enlarge

(Source: MBA)

Click to enlarge

(Source: MBA)

Click to enlarge

(Source: MBA)

Click to enlarge

(Source: MBA)

The report noted that the Conventional, Government, Conforming and Jumbo MCAIs are constructed using the same methodology as the total MCAI and are designed to show relative credit risk/availability for their respective index.

The primary difference between the total MCAI and the Component Indices are the population of loan programs that they examine.

According to Freddie Mac CEO Donald Layton, lenders will hopefully start lending even more. He recently went on the record asking for mortgage lenders to consider writing more low down payment mortgages in order for the government-sponsored enterprise to help increase access to credit to potential homeowners.

“The biggest obstacle is getting lenders to fully exploit the credit box,” he added, pointing to the 3% down payment mortgages Freddie Mac will now bundle and securitize.