A new program launching early next year will give borrowers the opportunity to protect their upfront investment in their home, just as lenders are able to do with mortgage insurance.

Meet down payment insurance – for borrowers.

The new down payment insurance program is called +Plus and is being offered by ValueInsured. Borrowers will be able to start using the +Plus program in Jan. 2016.

Under the +Plus program, borrowers will pay a premium to ValueInsured in exchange for having their down payment insured against a downturn in the housing market should they decide to sell their home.

Here’s how it works, courtesy of ValueInsured.

“+Plus works like the insurance homebuyers are already paying for at closing, such as private mortgage insurance, which protects the bank. But, with +Plus, the policy protects the homebuyer: If the market falls and the homeowner decides to sell, +Plus will reimburse them up to the full value of their down payment. The average cost for the protection is equivalent to less than a lunch per month.”

According to a report from the Seattle Times, the premiums are expected to average approximately $1,200 on a 10% down payment ($20,000) on a $200,000 house.

A borrower’s insurance claim isn’t necessarily guaranteed, though. There are some stipulations.

To receive repayment of their down payment, the sale of a borrower’s home must be at least two years after the original purchase, but not more than seven years after the original purchase.

Additionally, the home must be owner-occupied during the entirety of the coverage period. Borrowers are not allowed to rent out their homes.

Also, the sale must be to an unrelated third party and no leasebacks are allowed.

Borrowers will have their claim paid if the sale price of their house is lower than the original purchase price, and the Federal Housing Finance Administration Home Price Index for the borrower’s home states that at the time of sale it is lower than it was on the date they purchased the home.

In that instance, a borrower’s payout will be the lesser of their down payment (up to 20% of the home’s purchase price), the actual equity lost on the sale, or the purchase prices of the home multiplied by the reduction in the state’s FHFA HPI.

“When the down payment is protected, the modern American homebuyer experiences more control, confidence and flexibility, even in a volatile real estate market,” said Joseph Melendez, founder and CEO of ValueInsured.

“Our down-payment protection program is backed by one of the world’s largest re-insurance companies, with over $8 billion in capital,” Melendez added. “So consumers can count on us to be there if and when they need to get their money back when they sell their home.”

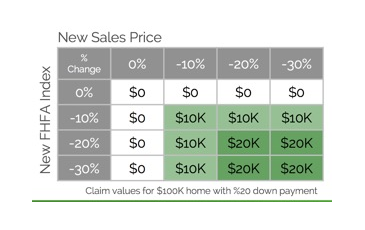

Below is an example, courtesy of ValueInsured, of how the program would work:

For example a borrower buys a home for $100,000 and puts 20% (or $20,000) down. In five years, the borrower decides to sell. The table below shows how the payout would depend on the sale price and the change in the HPI.

As the table shows, the borrower would receive:

No payout if the borrower sells at or above the price paid for the home, or if the HPI for their state has not decreased. These two scenarios are shown with white shading in the table.

A payout of less than the down payment if either the sale price or the HPI fell only slightly. Those scenarios appear in light green shading.

A full refund of the down payment if the sale price and the HPI fell by at least 20%. Those scenarios appear in darker green shading.

“The Millennial mindset has created today’s modern homebuyer,” said Cleve Bellar, chief marketing officer at ValueInsured.

“They have created a new set of home-buying expectations. They demand clear and simple services, terms that are fair and tools that give them control over their buying options,” Bellar said. “The Millennial mindset is not defined by age or demographics. It’s a group with common sense, savvy, the desire to control their own destiny and, ultimately, the need to protect their hard-earned savings.”

(h/t Realtor Mag)