Simply stating that student loans are the reason behind the decreasing homeownership rate is not enough, Freddie Mac’s latest Insight & Outlook report said.

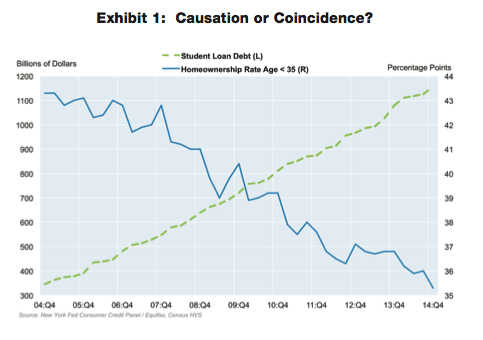

Many housing experts forecasted the homeownership rate—which has been declining since 2004—to rebound as Millennials entered the housing market.

But this isn’t happening.

Instead, the homeownership rate continues to decline, including the homeownership rate for the under-35-year-old segment of the market, as seen in the chart below.

Click to enlarge

(Source: Freddie Mac)

Many theories have evolved for the reason behind the decline, including reduced employment opportunities and different attitudes from Millennials toward homeownership.

Capital Economics published a report recently that questioned whether the rising burden of student debt is really the reason behind the weakness in home sales to first-time buyers.

This study from Freddie Mac asked if the simultaneous growth in student loan debt and the decline in the Millennial homeownership rate is just a coincidence, or is the burden of student debt a significant factor in the lower homeownership rates?

“While we can’t answer that question definitively, there are some tantalizing clues in the data,” the report said. “Student loan debt alone can’t explain the low homeownership rate among Millennials. After all, the homeownership rate in this cohort has dropped 5 to 6 percentage points for student loan borrowers and non- borrowers alike.”

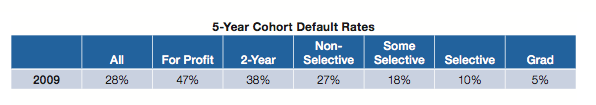

Freddie Mac references a recent Brookings Institution conference paper by Adam Looney of the U.S. Treasury and Constantine Yannelis of Stanford University to put the student debt problem into perspective.

“Using recently released data from the Department of Education, they found that most of the increase in student loan defaults is associated with the rise in the number of borrowers at for-profit schools and, to a lesser-extent, two-year colleges, and certain other non-selective schools,” the report said

On the other side, default rates have remained low among borrowers attending four-year public and non-profit private colleges.

And even further, this still holds true for most graduate borrowers despite the recession and relatively high loan balances. This low-default-rate group comprises the vast majority of the federal student loan portfolio.

Click to enlarge

(Source: Freddie Mac)

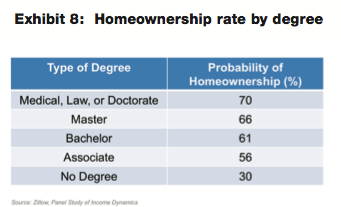

Those with no degree have a probability of home ownership less than half that.

Click to enlarge

(Source: Freddie Mac)

From these findings, Freddie separated student loan borrowers into three groups for how they approach homeownership and mortgage lending:

Successful investors:

Borrowers who completed their degrees and found that their post-college earnings are matching their expectations. Unless they are challenged to accumulate a down payment, student loan debt is not a significant deterrent to purchasing their first home. However, they may be delaying for other reasons.

Disappointed earners:

Graduates of four-year institutions whose return on their education investment is less- than-expected. They may not be able to find a job in their field and their wage income is lower than originally anticipated. Some of these borrowers took highly-specialized instruction in fields that deteriorated during their period of studies (for example, petroleum engineers graduating now). Their relatively low earnings and student debt burden may hinder homeownership for this group.

At-risk borrowers:

These are the borrowers identified by Looney and Yannelis in their analysis of the Department of Education data. Many of these borrowers are from less affluent groups. They may be economically worse off than before they started school—they have no improvement in their job prospects but they have significant student debts to repay. Delinquency and default on their student loans has hurt their credit scores.

“The low homeownership rate among Millennials is still something of a puzzle—it cannot be explained solely by the increase in student loan debt. However student debt plays a role—higher balances are associated with a lower probability of homeownership at every level of college and graduate education. And recent data has confirmed that student borrowers are not alike,” the Freddie report concluded.