Over the last two years, the single-family rental (SFR) market has been on a roll. More than 20 deals, valued at more than $13 billion have come to market, including the much-anticipated first multi-borrower transactions. But is the market a short-term phenomenon created by the foreclosure crisis or the real deal fueled by long-term demographics and economic trends?

Those questions were the topics of a panel at ABS East that I was a part of. The panel focused on “value” and the SFR market: what could create and sustain the SFR market or, conversely, derail it? It examined the depth of the market, new liquidity options, and a variety of risks, including home price fluctuation.

As the economist on the panel, I provided the macroeconomic outlook for the sector, and, by and large, when you drill down into the numbers, they are very positive.

First of all, the largest demographic cohort in the country is now Millennials, age 22 to 25 years, getting ready to form new households. Meanwhile, the average age of first-time homebuyers is moving up into the 30s.

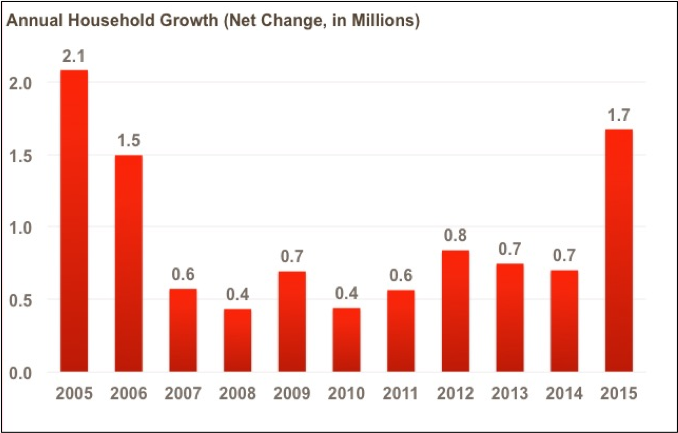

Since the great recession began, household formation has been anemic. But this year household formation will be at its highest point in 10 years — close to 1.7 million new households — many of which will be renters.

Click to enlarge

(Source: U.S. Census Bureau, Housing Vacancy Survey. Net change in number of households, January-to-June compared with same period in prior year.)

As a result of the mortgage crisis, over the past seven years, more than 5.8 million homeowners have lost their homes and many are now renters. This has also driven the growth of the single-family detached rental stock. In markets, like Phoenix and Las Vegas, for example that were hard hit by falling home values, the change in SFR rental stock is up roughly 80%.

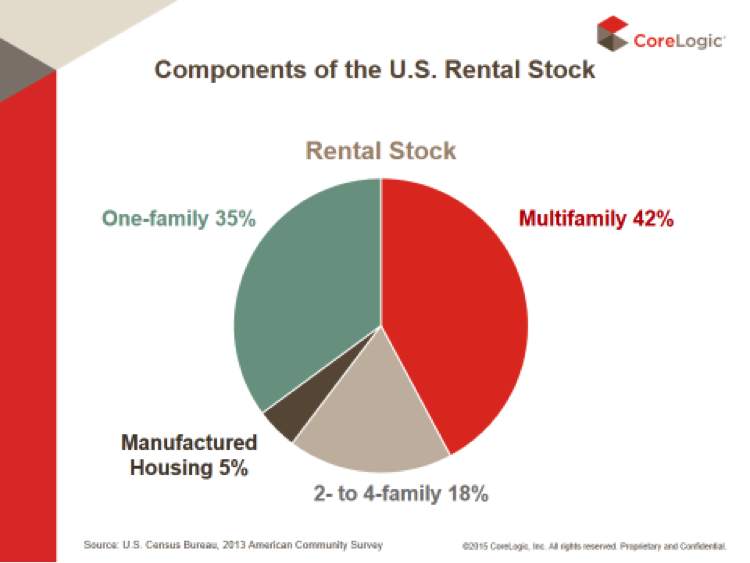

Approximately 35% of all rental stock is SFR and in 2Q had the lowest vacancy rate, less than 3% (compared to 8% or more in larger apartment buildings).

Click to enlarge

(Source: U.S. Census Bureau, 2013 American Community Survey)

Demand is pushing up rents in major markets. In Phoenix, for example, rents are up an average of nearly 10% year-over-year. In very tight markets, like San Francisco, rents are up an average of 18% this year.

From an investor’s perspective, the most important metric is always cap rate. Over the past three years, the national average cap rate for a three-bedroom SFR has been north of 6% and in around 5.5% for two bedrooms.

No matter how you crunch the numbers, the outlook for rentals looks strong for the foreseeable future.