The industry anxiously awaits an announcement from the Federal Reserve for news that can change the way the industry operates.

And while most economist opinions are already known, HousingWire wanted to know what our readers think!

The Federal Open Market Committee began meeting Wednesday morning and is charged with the decision of when they will raise the federal fund rates.

In the most recent FOMC meeting minutes from July 28-29, the committee announcement said, “When the committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2%.”

But since the July meeting, the market dealt with volatile changes due to the repercussions of Black Monday that hit the stocks that drive the housing and mortgage finance economy.

Most American economists are about 80% certain a rate hike is coming. Even European analysts expect a hike. In a recent Société Générale US Credit comment, analysts tell its equities investors the Fed will move ahead – most likely Wednesday, but by October or December for certain.

"Although admittedly a close call, our economists still expect Fed lift-off to be announced this week, but they also envision the Fed to have ‘dovish packaging’ that provides indications of no further hikes in 2015 and a gradual pace of tightening,” they say in a client note. “If instead a no-hike scenario were to play out, our economists expect that the accompanying statement would not be dovish, but instead leave prospects for a 2015 hike on the table – in October or December.

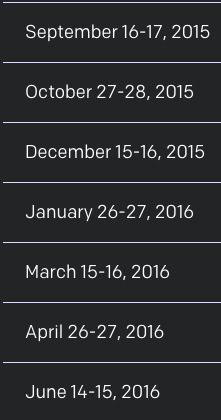

So what do HousingWire readers think?

HousingWire opened a quick poll on Monday for readers to give their input before the Fed meeting this Wednesday.

While it wasn’t an overwhelming majority, most readers think the Fed will raise rates in this September meeting.

The next option would be the December meeting.

Click to enlarge

The Fed’s press conference is tomorrow, leaving 24 hours until we can find out if they are right or not.