An insufficient supply of affordable inventory in desirable locations is blocking the housing market from growing, which comes on top of August being a seasonally slow month.

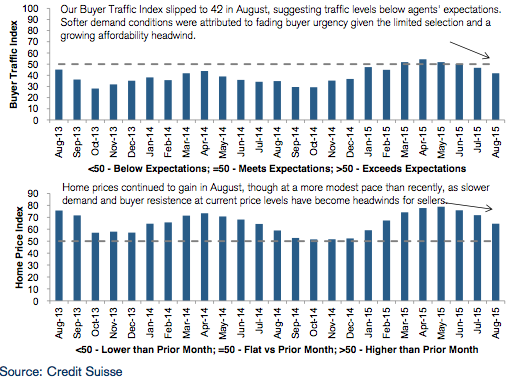

According to the latest Credit Suisse (CS) monthly survey of real estate agents, “Agent comments largely focused on growing buyer disinterest at current home prices. On the other hand, demand trends continue to receive support as buyers try to beat any potential increases in mortgage rates.”

In the last survey from Credit Suisse, most agents were concerned about how rising interest rates would impact demand.”

The most recent Freddie Mac Primary Mortgage Market Survey reported that the 30-year fixed-rate mortgage averaged 3.9% for the week ending Sept. 10, 2015, up from last week when it averaged 3.89%.

As a whole, the Buyer Traffic Index decreased to 42 in August from 47 in July, indicating traffic trends below agents’ seasonal expectations. This is the first time since February.

Click to enlarge

(Source: Credit Suisse)

Here’s how the top three housing markets are doing in the country.

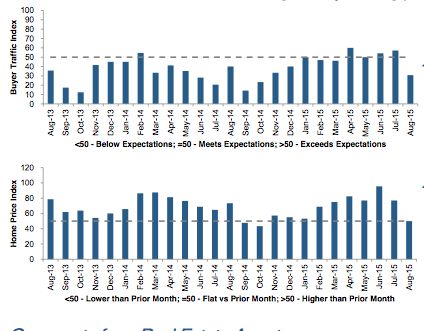

3. Atlanta, Georgia

Demand in the city contracted in August, marking the first “below expectations” reading in 2015. The Buyer Traffic Index fell to 31 in August from 57 in July.

“Incrementally, agent comments turned more cautious, discussing negatives such as recent price increases, further deterioration of existing inventory quality, and less security in the local economy,” the report stated.

Click to enlarge

(Source: Credit Suisse)

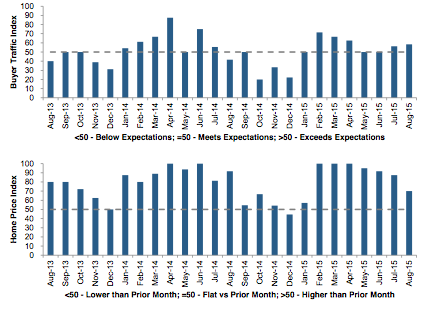

2. Dallas, Texas

Dallas experienced stable traffic trends, with agents noting conditions above expectations. The Buyer Traffic Index edged up 2 points to 58 in August.

“Agents continue to point to a strong employment market as driving the consistent demand trends. Some mentioned that lower price point homes had better activity and interest than more expensive listings,” stated the survey report.

Click to enlarge

(Source: Credit Suisse)

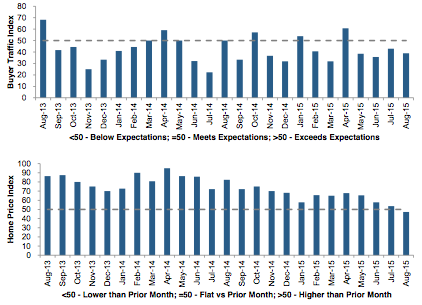

1. Houston, Texas

The Buyer Traffic Index for Houston came in at 39 in August, which is down 4 points month-over-month, as disappointing trends continue.

“Again, agents attribute the softness to the economic impacts of lower oil prices. Many discussed how listings have increased, while many buyers moved to the sidelines. Incrementally, sellers were willing to lower prices to drive transactions,” the report said.

Click to enlarge

(Source: Credit Suisse)