The online real estate listings service, Trulia, calculated how long homes are staying on the market by measuring the share of homes for sale on its site over a two-month period.

It looked at homes listed on June 17, then counted how many were still for sale on August 17.

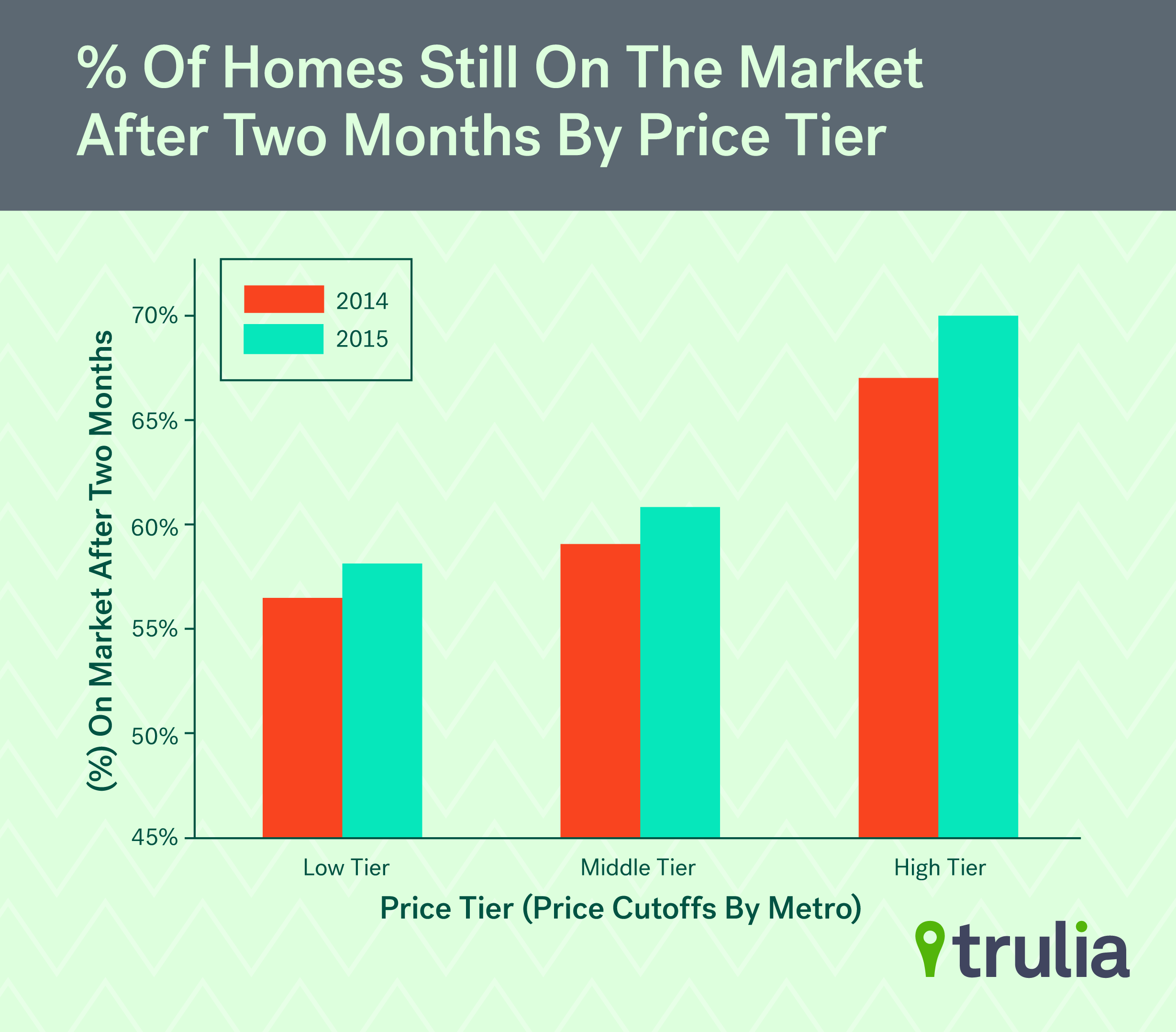

Nationally, 63% of homes listed for sale on June 17 were still on the market on August 17, which is up a bit from 61% for the same period last year.

Click to enlarge

(Source: Trulia)

A lot of the beginning of this year was spent telling homebuyers how they can secure a home in competitive housing markets through options like cover letters or waived inspections.

And while those tips are still useful, buyers can find comfort in the fact that they have a little bit more time to lock down a home without the threat of someone snagging it away.

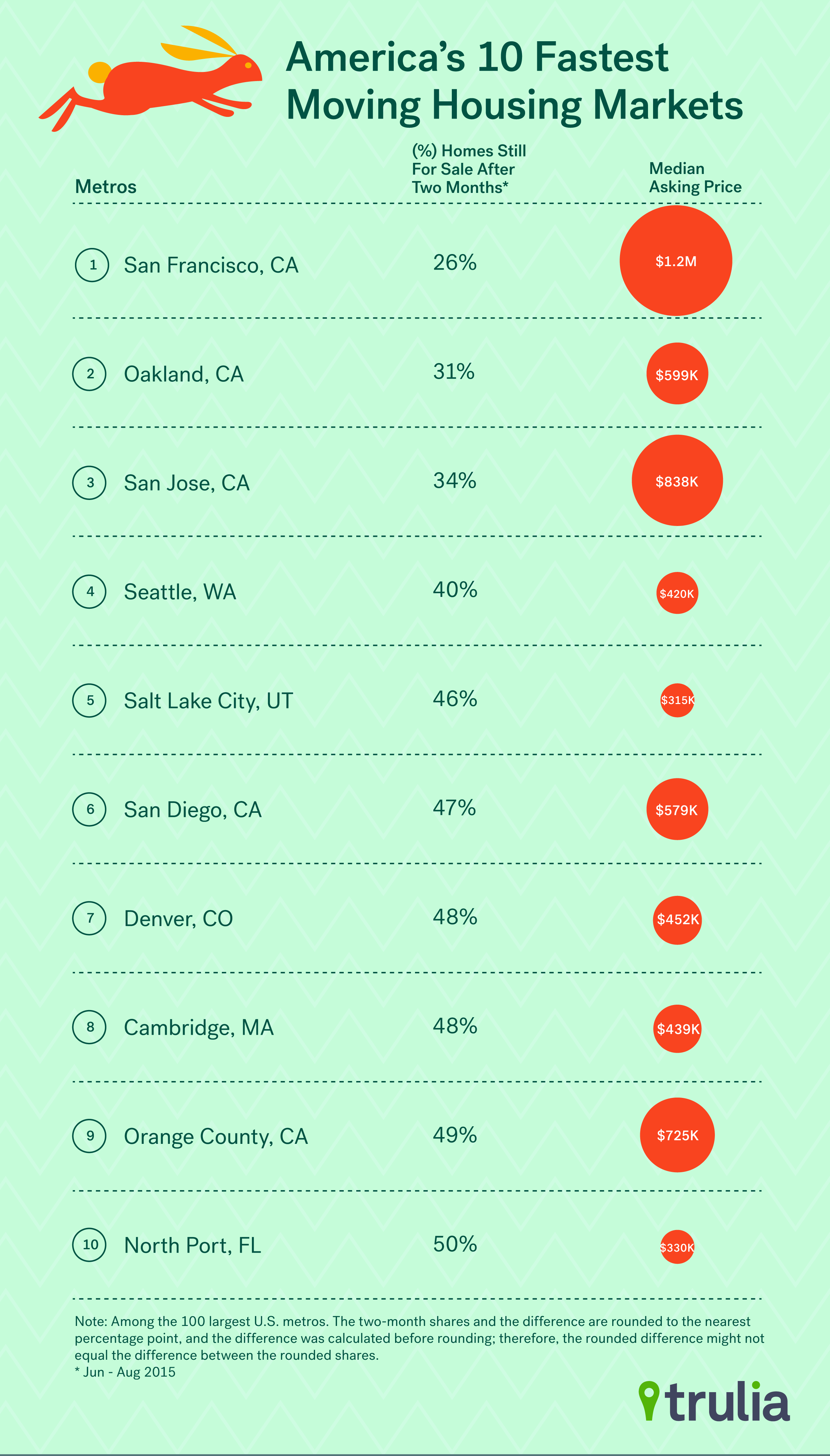

However, as Trulia cautioned, “The national trend hides big differences from one local market to another.”

These housing markets, despite a slight slowdown, are still moving fast.

Click to enlarge

(Source: Trulia)

California continues to hold most of the fastest moving markets, with San Francisco, Oakland, San Jose, San Diego and Orange County making the top 10 list of America’s fastest moving housing markets. Is your market moving faster or do you see homebuyers gaining the advantage? Please tell us in the message boards below the article.

Trulia said that increases in home prices is what, usually, strongly impacts the share of homes on the market after two months, but in this new report, affordability might be starting to play a role in the priciest markets.

This is attributed to the fact that homebuyers, no matter how competitive the market is, have a limit.

“When the stock of cheaper homes dries up, not every buyer is able to up their budget and put offers on homes in a higher price tier. So some may delay buying a home, which leads to existing homes sitting on the market a tad longer,” the report said.

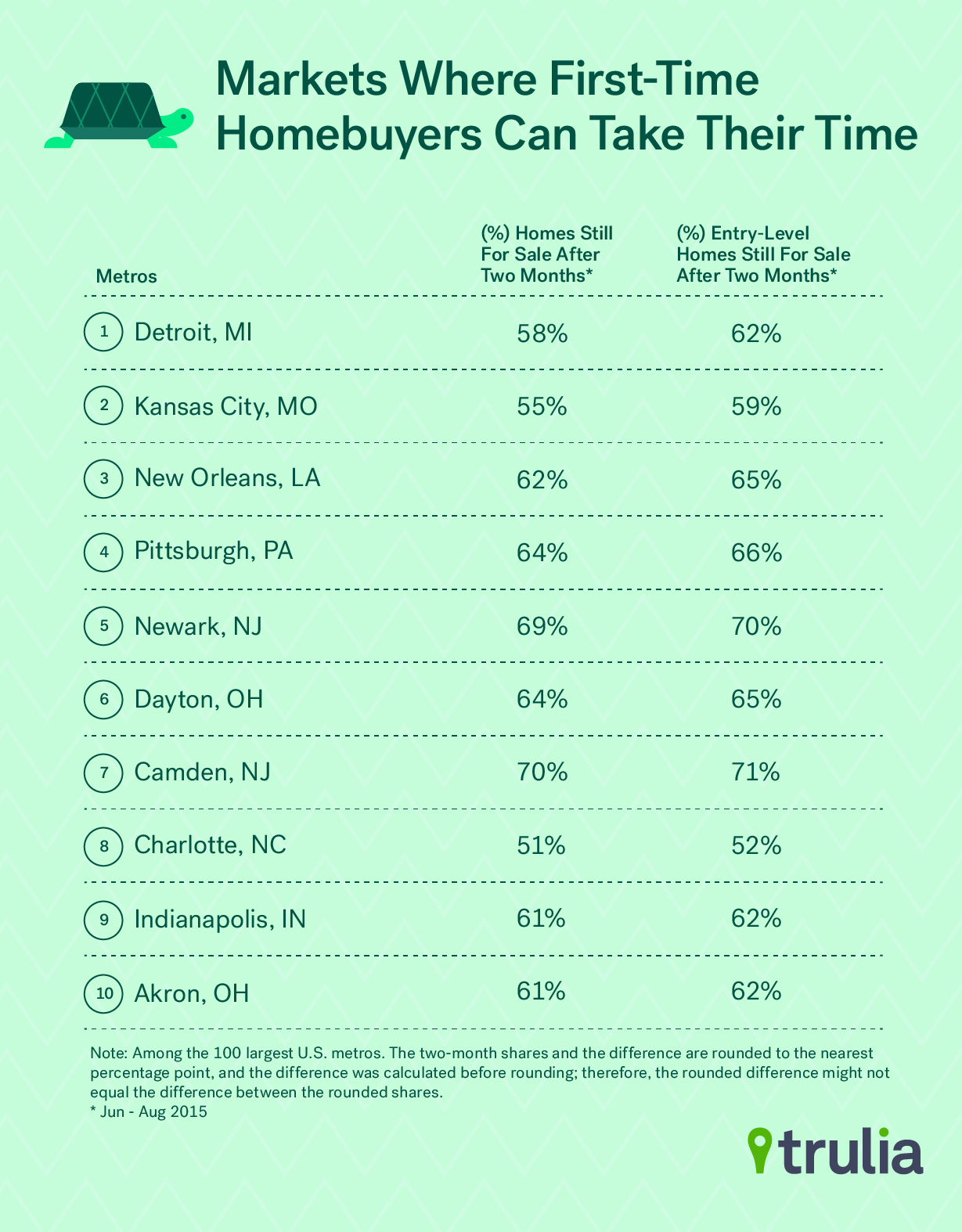

First-time homebuyers shopping in the Midwest and South have it best when it comes to affordability since low-tier homes there actually move slower than the market as a whole.

Here are the top 10 markets where first-time homebuyers can take their time.

Click to enlarge

(Source: Trulia)

Do you agree homebuyer could get the upper hand soon? Please use messageboard below to comment.