Despite efforts to combat the glut of foreclosures that have choked New York’s court system and blighted many of the state’s neighborhoods, a new report from the New York comptroller shows that the state’s foreclosure crisis is nowhere close to being resolved – and in many cities, it’s actually getting worse.

The report, released Monday by New York State Comptroller Thomas DiNapoli, shows that areas immediately outside of New York City have the greatest number of pending foreclosures in the state.

And those areas aren’t getting any better. According to the report, the number of pending foreclosure cases in Long Island and the Mid-Hudson region rose 63% from 25,097 at the beginning of 2013 to 40,985 in 2015.

During the same time period, pending foreclosure cases across upstate grew by 47%, the report showed.

“The foreclosure crisis is far from resolved, and there are still too many people losing their homes,” DiNapoli said.

“In many places the situation has continued to get worse,” DiNapoli continued. “Foreclosed properties displace families and weigh heavily on local communities, reducing property values and eroding tax bases. We must continue efforts to help homeowners and stem the spread of foreclosure-induced blight.”

Earlier this year, while speaking at the Mortgage Bankers Association’s National Secondary Market Conference in New York City, Benjamin Lawsky, the now-former Superintendentof the New York Department of Financial Services, said that the state’s “foreclosure process is broken and badly in need of change.”

Due to New York’s judicial foreclosure process, a private-label RMBS loan in New York currently spends an average of 1,498 days in foreclosure proceedings before exiting. That’s up from 1,339 days compared to 2013.

“Averaging over 900 days from the date of filing to sale – nearly double the national average – the foreclosure process is not only unacceptably protracted, but also unquestionably damaging for New Yorkers, including the homeowners it is intended to protect,” Lawsky said in May.

“I want to make one point crystal clear: Protecting homeowners should be a paramount goal,” Lawsky continued. “The monstrous foreclosure abuses we saw during the financial crisis demonstrate we should never let our guard down when pursuing well-intentioned reforms.”

DiNapoli’s report shows that there has been some slight improvement in the state’s foreclosures in the last few years, but notes that the state’s level of foreclosure activity is still “well above” pre-crisis levels.

According to DiNapoli’s report, foreclosure filings rose rapidly after the housing bubble burst and the recession of 2008-2009 took hold.

Between 2006 and 2009, the number of new foreclosure cases filed in the state jumped from 26,706 to 47,664, an increase of 78%. In 2011 and 2012, new filings declined as new court rules were issued requiring lenders to affirm their claim to the property.

Since reaching a low of 16,655 in 2011, new filings climbed to 46,696 by 2013 before falling to 43,868 in 2014, still well above prerecession levels.

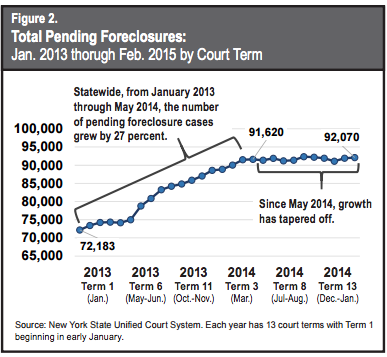

The Comptroller’s report shows the number of pending foreclosure cases grew by 27% from the beginning of 2013 to May 2014, from 72,183 to over 91,600.

But since then, the pending caseload has remained fairly steady at over 90,000.

Click the image below to see a look at the number of pending foreclosures in New York.

(Image courtesy of the New York Comptroller’s report)

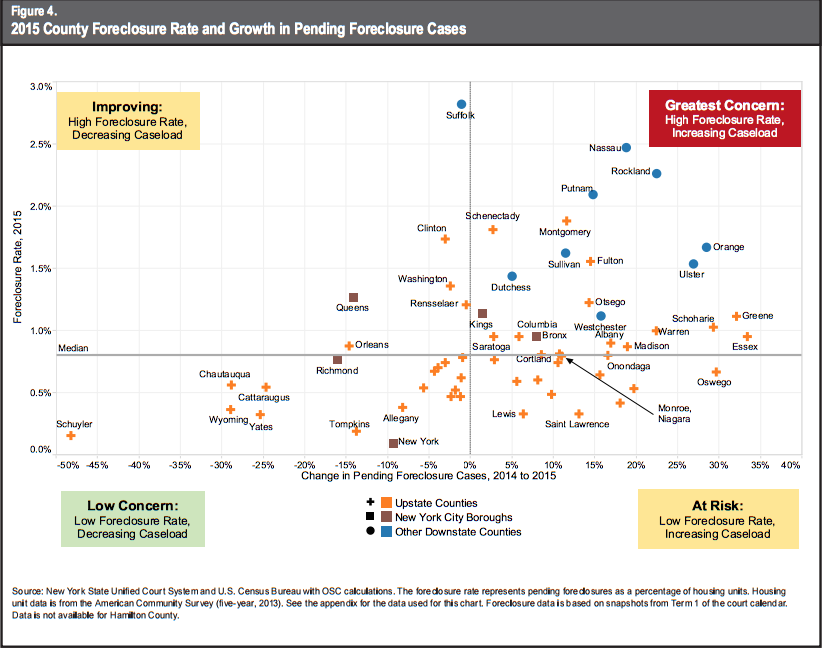

DiNapoli’s report also broke down the state’s foreclosure rates by county, with many downstate counties falling in the “greatest concern” category, characterized by high foreclosure rates and increasing caseloads.

Click the image below to see a breakdown by county of the state’s foreclosure rates.

(Image courtesy of the New York Comptroller’s report)

DiNapoli’s report does show that there could be some light at the end of the tunnel though, with small signs of improvement beginning to show.

“One sign that we could begin to see a noticeable reduction in the statewide pending caseload is that foreclosure activity at the beginning of the process (“lis pendens” filings, a pre-foreclosure action in which lenders file notification of a pending lawsuit) is slowing, while activity at the end of the process (notices of sale, notification that the property has been scheduled for public auction) is accelerating.,

DiNapoli’s report states.

“Indeed, in New York City, the foreclosure crisis appears to have already turned the corner, with 2014 results showing year-over-year decreases in both lis pendens filings and notices of sale compared to 2013,” the report continues. In the rest of the state, lis pendens filings grew by only 1.3% from 2013 to 2014, while notices of sale grew by 78%.”

DiNapoli’s report also cites the efforts by the NYDFS to combat foreclosures in the New York, stating that the reforms laid out by Lawsky in May have potential to help the state’s foreclosure surplus.

Click here to read DiNapoli’s full report.