Walker & Dunlop (WD) posted a second quarter 2015 net income of $20.2 million, or $0.67 per diluted share, a 56% increase from second quarter 2014 net income of $12.9 million, or $0.40 per diluted share.

Total revenues were $113.9 million for the second quarter 2015, a 34% increase over the second quarter 2014.

Gains from mortgage banking activities for the second quarter 2015 jumped to $70 million compared to $52.2 million for the second quarter 2014, a 34% increase.

This increase was primarily driven by the substantial growth in loan originations coupled with an increase in the weighted average servicing fee on Fannie Mae loans originated during the quarter.

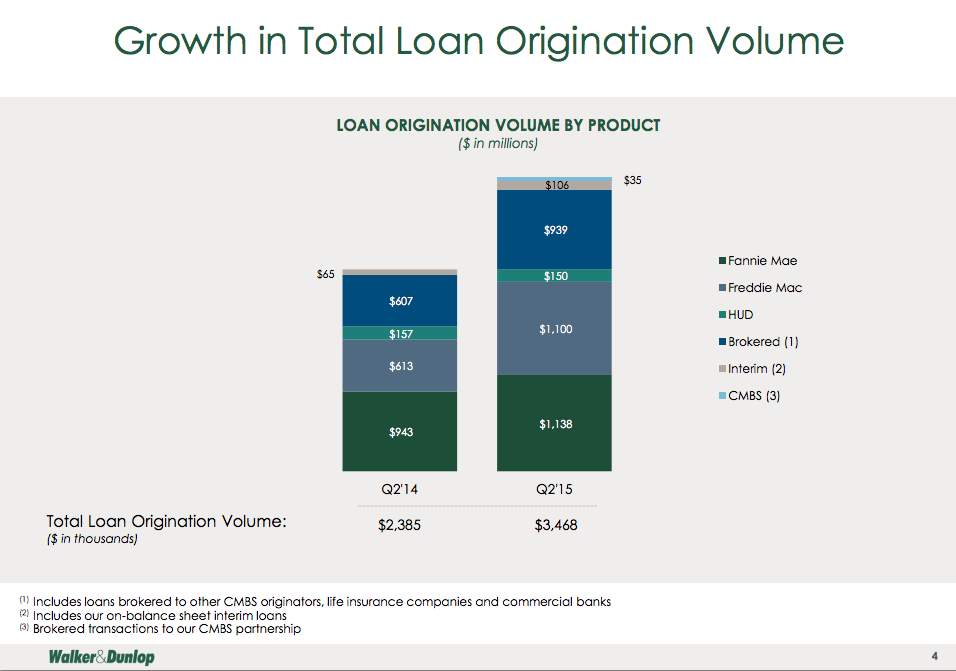

Loan origination volume soared to $3.5 billion for the second quarter 2015 compared to $2.4 billion for the second quarter 2014, a 45% increase.

Loan originations with Fannie Mae and Freddie Mac were both $1.1 billion, representing increases of 21% and 79% from the second quarter 2014, respectively.

This chart illustrates the company’s second-quarter success in mortgage originations.

Click to enlarge

(Source: Walker & Dunlop)

"I would like to congratulate every member of the Walker & Dunlop team for generating record revenue and earnings per share during the second quarter of 2015," said Walker & Dunlop Chairman and CEO Willy Walker.

"Our strong financial results are due to the fantastic group of professionals we have assembled and the market leadership position we have worked very hard to create. We continue to grow and gain market share, all while expanding our brand and expertise across the country,” Walker added.