There are countless reasons and explanations that play into what neighborhood is best for a homebuyer.

To help ease the process, WalletHub compiled a list of 300 U.S. cities to determine the attractiveness of their first-time homebuyer markets.

When it comes to what homebuyers should conider when choosing a neighborhood, Robert Van Order, the Oliver Carr Chair in Real Estate and Professor of Finance and Economics at The George Washington University School of Business, said:

“(It) depends on how long they expect to stay and the type of unit. If short run and, say, a condo, look to how strong sales have been and if they can resell. If more permanent, it depends on lifestyle – e.g., if looking to raise kids, first thing might be schools. Be sure to study sales of comparable housing in the area.”

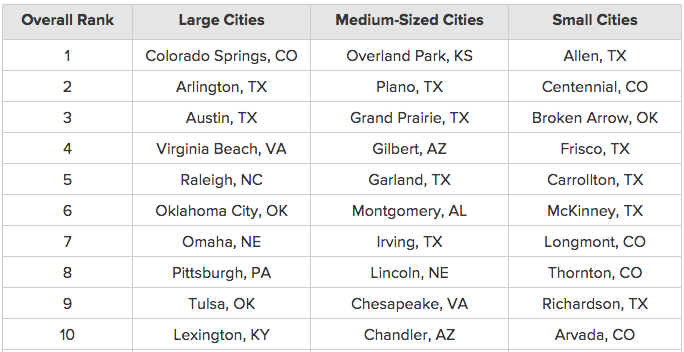

WalletHub assessed the real-estate landscape within 300 U.S. cities by examining three key dimensions: housing affordability, real-estate market and living environment.

And here are the top 10 best cities for first-time homebuyers

Click to enlarge

Source: WalletHub

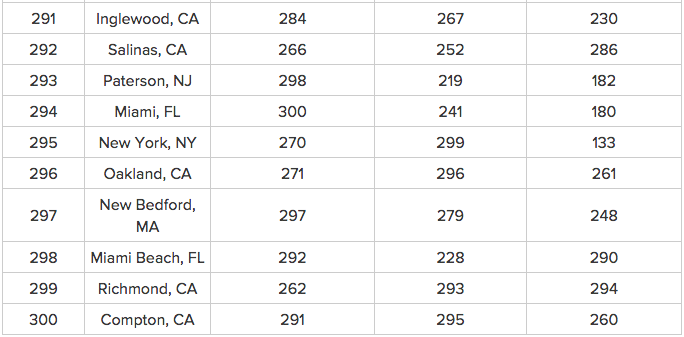

The worst 10 cities for first-time homebuyers

Click to enlarge

Source: WalletHub