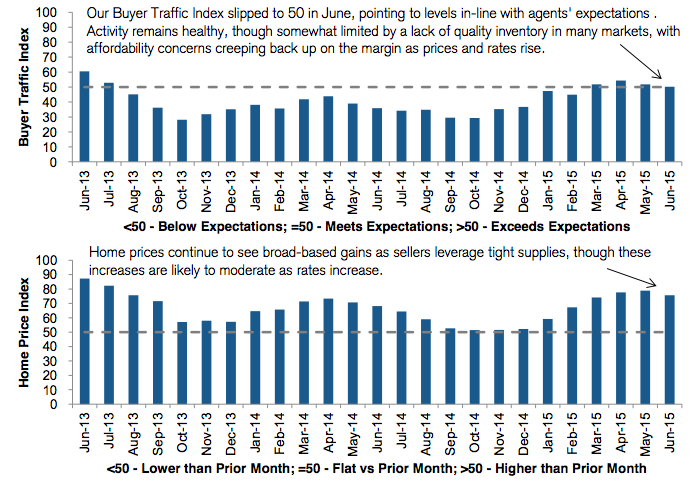

While the housing market is still healthy, the potential impact of rising mortgage interest rates remains on most real estate agents’ minds this summer.

According to the latest Credit Suisse (CS) monthly survey of real estate agents, “The demand environment is seemingly remaining healthy as agents and their buyers see continued economic improvement.”

Despite the talk of rising mortgage rates, not everyone believed it was bad news, with the impact varying evenly between motivator or deterrent, indicating fatigue may be growing but is not pushing people out of the market entirely.

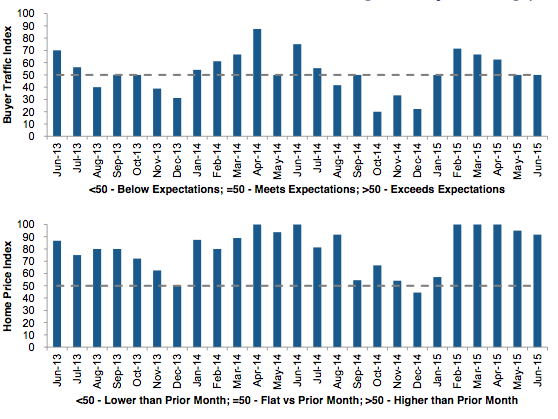

As a whole, the buyer traffic index edged down to 50 in June from 52 in May, indicating traffic trends in-line with expectations.

Click to enlarge

Source: Credit Suisse

Here’s how the top five markets are doing in the country:

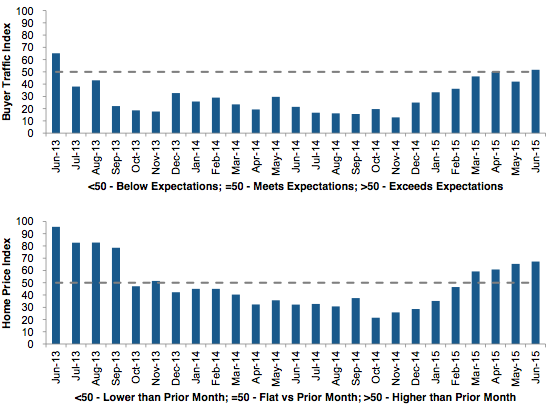

5. Phoenix, Arizona

Demand in the city edged higher in June as its traffic buyer index increased to 52 from 42 in May. Agents in the area said that the combination of rising rates and prices has given buyers an incentive to close a transaction quicker. But despite this, some buyers still were pushing back on pricing, even with the sellers’ advantage in a constrained inventory environment.

According to one local agent, “Sellers are holding to list price, not giving buyers any reason to make quick decisions.”

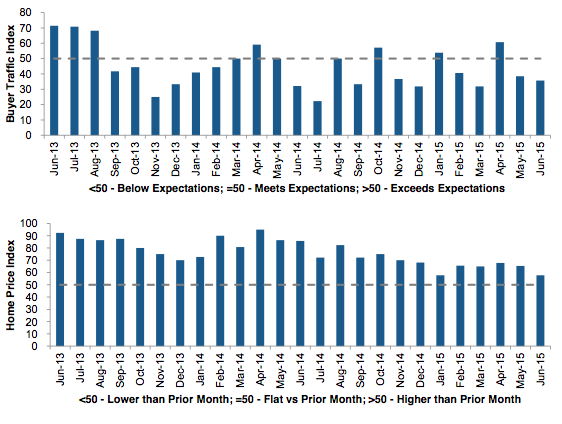

Click to enlarge

Source: Credit Suisse

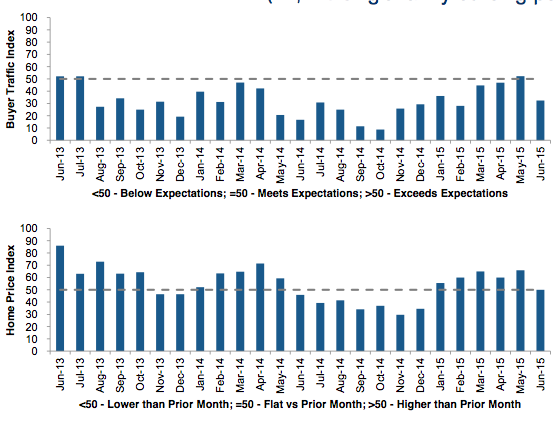

4. Washington, D.C.

June failed to keep the positive trend going after the index broke above a neutral 50 in May for the first time since mid-2013. A local real estate agent said, “Rising interest rates, prices and vacations seem to be having an impact. Activity definitely slower than in May.”

Click to enlarge

Source: Credit Suisse

3. Atlanta, Georgia

Atlanta’s traffic levels slightly increased in June, staying in-line with agents’ expectations. The traffic index came in at 54, up from 50 in May. Although agents indicated overall inventory levels remained very low, further pricing gains frustrated buyers as more homes were pushed out of reach.

“New inventory consistently hitting the market. We are seeing signs of a shift to a more balanced markets – more inventory and fewer multiple offers,” a local agent said.

Click to enlarge

Source: Credit Suisse

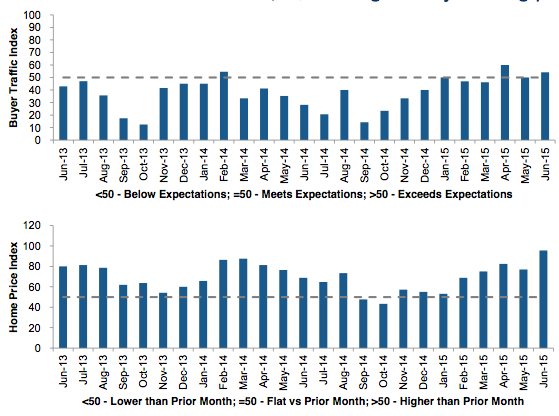

2. Dallas, Texas

Dallas continued to keep a steady pace, with traffic in-line with agents’ expectations again, reading 50 for the second consecutive month. According to local agents, continued population growth and corporate relocations underpinned better demand trend. Other local agents said they are finally starting to see a slight shift in the market such as slightly longer days on the market and a little less sense of urgency.

Click to enlarge

Source: Credit Suisse

1. Houston, Texas

Houston’s buyer traffic slightly dipped in June, dropping to 36 from 39 in May. Local agents noted the “threat of rising interest rates” and the “economy slowing” and factors contributing to the market. Commentary was a bit more negative due to lower oil prices.

Click to enlarge

Source: Credit Suisse