The average level of guarantee fees charged has increased since 2009, according to the latest report to Congress from the Federal Housing Finance Agency.

Under the Housing and Economic Recovery Act of 2008, the FHFA must submit a report to Congress on the g-fees charged by Fannie Mae and Freddie Mac.

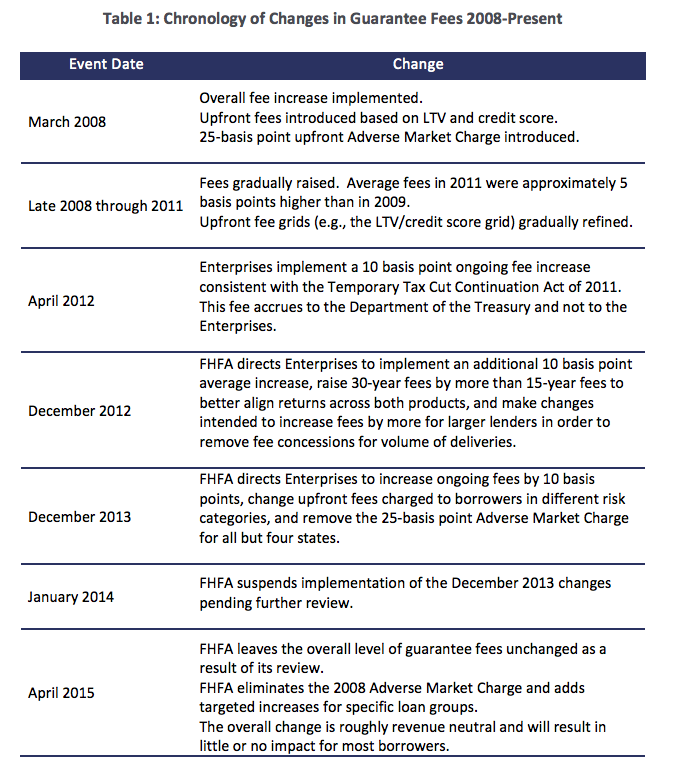

This chart shows the changes to g-fees from its start in 2008.

Click to enlarge

Source: FHFA

From 2009 to 2014, average fees increased from 22 basis points to 58 basis points, and from 2013 to 2014, average fees increased from 51 basis points to 58 basis points.

In April 2015, the FHFA said that it reviewed the agency’s policy for guarantee fees charged by the enterprises to lenders. Whie the FHFA decided not to change the general level of fees, FHFA made certain minor and targeted fee adjustments.

"Overall, the set of modest changes to guarantee fees is roughly revenue neutral and will result in little or no change for most borrowers," the FHFA stated.