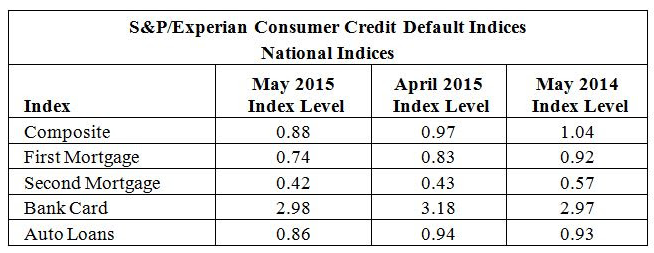

The first mortgage default rate recorded a historical low, dropping nine basis points to 0.74%, as more homebuyers pay their mortgages.

Overall, the composite index posted its second consecutive historical low of 0.88% in May, a decrease of nine basis points, according to the latest S&P/Experian Consumer Credit Default Indices, which gives a comprehensive measure of changes in consumer credit defaults.

And the trend doesn’t stop there. The second mortgage default rate also posted a second consecutive historical low of 0.42%, down one basis point from the previous month.

Click to enlarge

Source: S&P/Experian Consumer Credit Default Indices

“Consumer credit default rates are below pre-crisis levels, at new lows and continue to drift down,” said David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices.

But Blitzer explained that these low levels should not come as a surprise: interest rates haven’t turned up, consumer debt service as a proportion of household income is close to its record low and the Federal Reserve reported that consumer wealth was at a peak in the first quarter of 2015.

And he disclaimed that it’s not because no one is spending.

“On the contrary, May light vehicle sales were the highest since July 2005 and retail sales jumped. The economy looks good, consumers are spending and credit usage is rising. The combination of low debt service and economic expansion should ease worries about the fallout some fear when the Federal Reserve boosts interest rates,” he added.

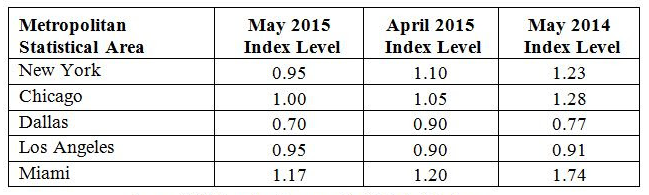

Four of the five major cities also continued their downward trend, with Los Angeles reporting the only rate increase, moving up five basis points to 0.95%. This is its third consecutive monthly increase.

Click to enlarge

Source: S&P/Experian Consumer Credit Default Indices

“Two of the five cities – New York and Dallas – reported their lowest mortgage default rates since the series started in April 2004; the other three cities reported post-recession lows. During the housing collapse, Miami was one of the hardest hit cities in the country; Los Angeles also experienced a sharp rise in defaults and foreclosures,” Blitzer said.

“These figures are another indication that housing is recovering. Moreover, other data on financial difficulties confirm that foreclosures are declining and consumers’ capability and willingness to borrow are improving,” he continued.