The average down payment across the nation is dropping, signaling now is a good time to enter the homebuying market, according to a new report from LendingTree.

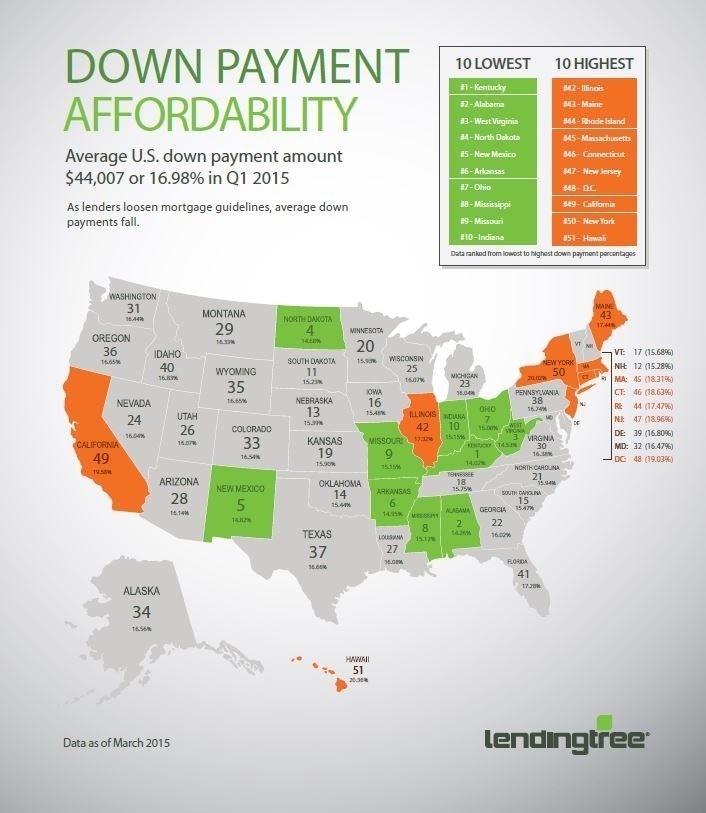

Down payment percentages for conventional 30-year fixed rate purchase mortgages decreased in the first quarter to an average of 16.98%, down from 17.59%, in fourth quarter 2014.

The average down payment amount also fell quarter-over-quarter to $44,007 from $47,585 in the previous quarter.

"As lenders need more mortgage volume, average down payments start to drop," said Doug Lebda, founder and CEO of LendingTree. "More lenders are beginning to loosen their guidelines and are going after a slightly broader pool of potential borrowers. For first time homebuyers, this spring and summer homebuying season is proving itself to be an excellent time to enter the market."

This infographic ranks each state according to the average down payment percentages offered to LendingTree customers from lowest to highest.

Click to enlarge

Source: LendingTree