Rising rents in many regions are a positive for single-family rental investors, with half of the top 50 housing markets good places to buy in now, according to a recent Deutsche Bank [DB] market outlook report.

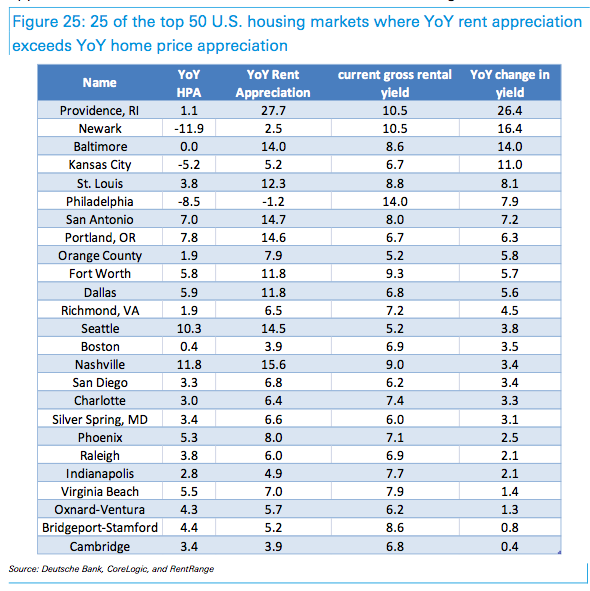

The report ranked top housing markets by appreciating annual gross rental yield and depreciating annual gross rental yield. For SFR investors, the best markets for a profit are where rent appreciation exceeds home-price appreciation.

Of the largest 50 MSAs covered, 44 markets experienced year-over-year increases in rent, compared to 46 of the 50 top housing markets that experienced year-over-year home-price appreciation.

As a result, the report found 25 housing markets where year-over-year rent appreciation exceeds year-over-year home-price appreciation.

“U.S. housing has had a remarkable recovery that is broad-based across different geographic regions. Home-price appreciation has also been evident in various transaction types consisting of foreclosure sales, short sales, new construction and normal existing home sales,” Ying Shen and Song Yang, research analysts with Deutsche Bank, said.

“Depending on the depth of distress housing inventory, some regions have had large price appreciations on single-family properties that put downward pressure on gross rental yields. However, rising acquisition price does not necessarily lead to declining gross yield. The opposite could be true in the local market with faster rent appreciation. For SFR investors, rising rental income is positive and rising acquisition price is negative to gross rental yield,” the analysts added.

Here are the 25 SFR markets where rent appreciation exceeds home price appreciation, making them good places to buy.

Click to enlarge

Source: Deutsche Bank