Analysts at Goldman Sachs [GS] are telling clients to look for the Federal Reserve to raise interest rates above the current level of 0% in mid-September.

However, in an email authored by Chief Economist Jan Hatzius, this forecast for rising interest rates to begin in September remains “a close call.”

He also urges the Federal Open Market Committee, which sets the timeframe for lifting the current Zero Interest Rate Policy, to fully consider all its options before rendering a final decision.

“We think the risk management case for delaying the first hike until 2016 remains persuasive,” Hatzius writes. “There is substantial uncertainty around the economic outlook, the equilibrium funds rate, and the true amount of labor market slack. This uncertainty has asymmetric effects on optimal monetary policy, and generally favors waiting.”

ZIRP is a form of economic stimulation whereby the federal government lends to financial institution at favorable rates until economic conditions support the removal of the policy.

Without ZIRP, the cost of lending would increase. So, for example, the low rates on mortgages enjoyed by consumers today will begin to rise.

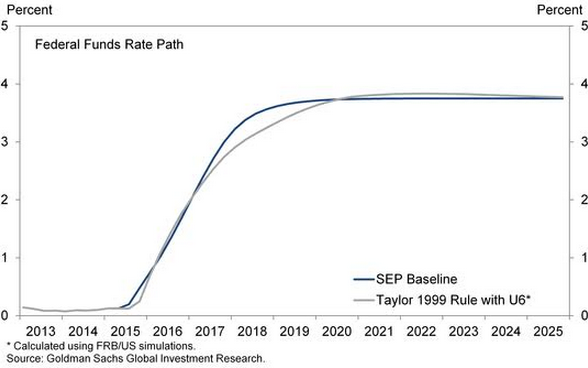

From the September rise, the Federal Funds Rate will continue to increase before leveling out below 4% in 2018.

See chart below, click to enlarge: