As we creep ever so slowly towards November 2016, presidential candidates step into the spotlight and declare their intentions to be the country’s next president.

Despite the election being 18 months away, the campaign is already in full swing.

Recently, one candidate for the White House actually said something that gives us at HousingWire a little hope for the next 18 months, even if his statement appears to be totally wrong.

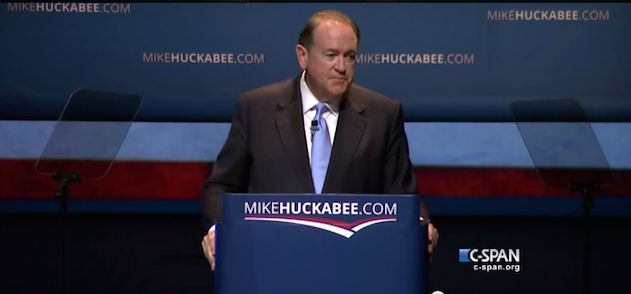

Former Arkansas Gov. Mike Huckabee announced his campaign earlier this month in his hometown of Hope, Arkansas. In his first speech as an official candidate, Huckabee touched many of the expected touchstones of his campaign, including the “dysfunctional” government in Washington, repealing Obamacare, “conquering” jihadism, banning both abortion and gay marriage.

But Huckabee also touched, ever so briefly, on an issue that HousingWire follows very closely – housing.

Here’s the important bit for those us who monitor housing closely, bolded for emphasis –

Washington is more dysfunctional than ever and has become so beholden to the donor class who fills the campaign coffers that it ignores the fact that one-in-four American families are paying more than half their income for housing. Home ownership is at the lowest level in decades and young people with heavy student debt aren't likely to afford their first home for a while.

Our federal policies for affordable housing aren't designed to protect families, but to protect bureaucrats. A record number of people are enrolled in government operated help programs like food stamps, not because they want to be in poverty, but because they are part of the bottom earning 90% of American workers whose wages have been stagnant for 40 years. The war on poverty hasn't ended poverty; it's prolonged it. I don't judge the success of government by how many people are on assistance, but by how many people have good jobs and don't need government assistance.

(Transcript provided by Real Clear Politics)

Huckabee isn’t wrong in his comments on the amount that American’s are currently paying for housing or that homeownership is at a record low, but there is one part where Huckabee is mistaken – at least according to a new report from TransUnion.

The new report from TransUnion shows younger consumers with student debt are actually quite able to get a mortgage.

According to the TransUnion report, consumers between the ages of 18 and 29 with a student loan in repayment are “generally able” to gain access to new loans and perform as well or better on those new loans as similarly aged consumers without student loans.

However, for every report saying student loans impacgt housing, it seems another report claims otherwise, such as this from the Consumer Financial Protection Bureau.

So, Huckabee isn’t alone in questioning the supposed burden that student debt places on younger borrowers.

In fact, President Obama announced plans last summer to expand a program designed to make it easier for borrowers to pay back their student loans.

In June 2014, Obama said that he would be directing Secretary of Education Arne Duncan to expand the “Pay as You Earn” law, which caps student loan repayments at 10% of monthly income. The new changes were expected to increase the program’s pool of eligible participants by nearly 5 million people, President Obama said.

In his remarks, President Obama spoke of the “crushing” debt that students face and how it impedes economic growth. “At a time when college has never been more important, it’s also never been more expensive,” Obama said. “If somebody plays by the rules, they shouldn’t be punished for it.”

According to the latest report from the Federal Reserve Bank of New York, student loan debt rose $32 billion in the first quarter to $1.19 trillion total, but TransUnion’s report and recent reports from Capital Economics suggested that growing amount of student debt isn’t actually preventing millennials from buying a home.

But the issue is complex. HousingWire's own Jacob Gaffney recently recapped remarks from the Federal Reserve’s Director of Research, James McAndrews. In a speech to the National Association of College and University Business Officers, McAndrews cited higher tuition costs coupled with more people attending college as the primary reason for the big jump in the nation’s student loan debt.

"Clearly for the substantial and growing group of student loan borrows who are delinquent or have defaulted on their debt, access to credit is reduced through potentially long-lasting negative effects on credit scores," McAndrews said.

With student loan debt nearing $1.2 trillion, it’s easy to see why many (politicians and others) believe that student loan debt is holding back the mortgage market.

A recent article from the Washington Post suggests that the economy and economic mobility is going to be a big player in the 2016 campaign.

From the Washington Post:

“You talk to any pollster, on the Democratic side or the Republican side, they’re in complete agreement on the idea that there has to be an economic populist message,” said Matthew Dowd, a top strategist for former president George W. Bush’s 2000 and 2004 campaigns. “Then it comes down to ‘Are there credible solutions and is there a credible candidate?’ ”

The truth about the impact of student loan debt on housing, as these things so often do, probably lies somewhere in the middle, but if Huckabee’s opening salvo is an indication that housing is on the electoral agenda for 2016, that’s a good thing, right or wrong.