Rental rates are rising all across the country, and the trend is not forecasted to change anytime soon. But this might not be a problem for millennials.

Rent.com conducted a survey of 1,000 millennial renters to find out how they are planning their next move, finding more than half (57%) rank affordability as the most important factor when choosing an apartment. Yet when asked, 55% said they are willing to spend up to $150 more per month in order to stay in an apartment they love. Nearly one in four respondents (24%) are willing to shell out an additional $400 a month, just to keep their pad.

And looking at industry trends, they might have to pay that extra money soon.

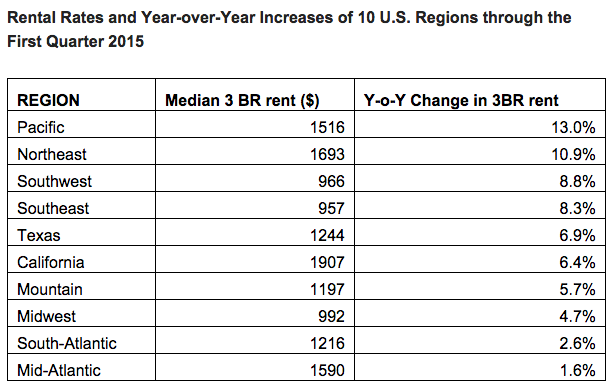

Real Property Management and RentRange’s latest data report found that through the first quarter 2015, the average monthly rent for single-family homes was $1,286, representing a 5.4% year-over-year increase. The rental market data was limited to three-bedroom single-family homes in the U.S.

“Rental rates are up throughout the country and we expect that trend to continue in the near future,” said Don Lawby, President of Property Management Business Solutions, the franchisor of Real Property Management. “There are a lot of economic indicators supporting that viewpoint, not the least of which is America’s continual shift toward renting.”

Click to enlarge

Source:

But can millennials actually afford to be spending as much money?

Going back the rent.com, it seems that the millennial heart and head are at odds.

Despite their desire for affordable apartments above all else, 22% of millennials are spending up to 40% of their annual income on rent.

In order to afford living, more than one in three millennial renters (39%) reported getting some financial help, with 24% turning to their parents for additional support, 9% receiving financial support from the government and 6% depending on the kindness of others.