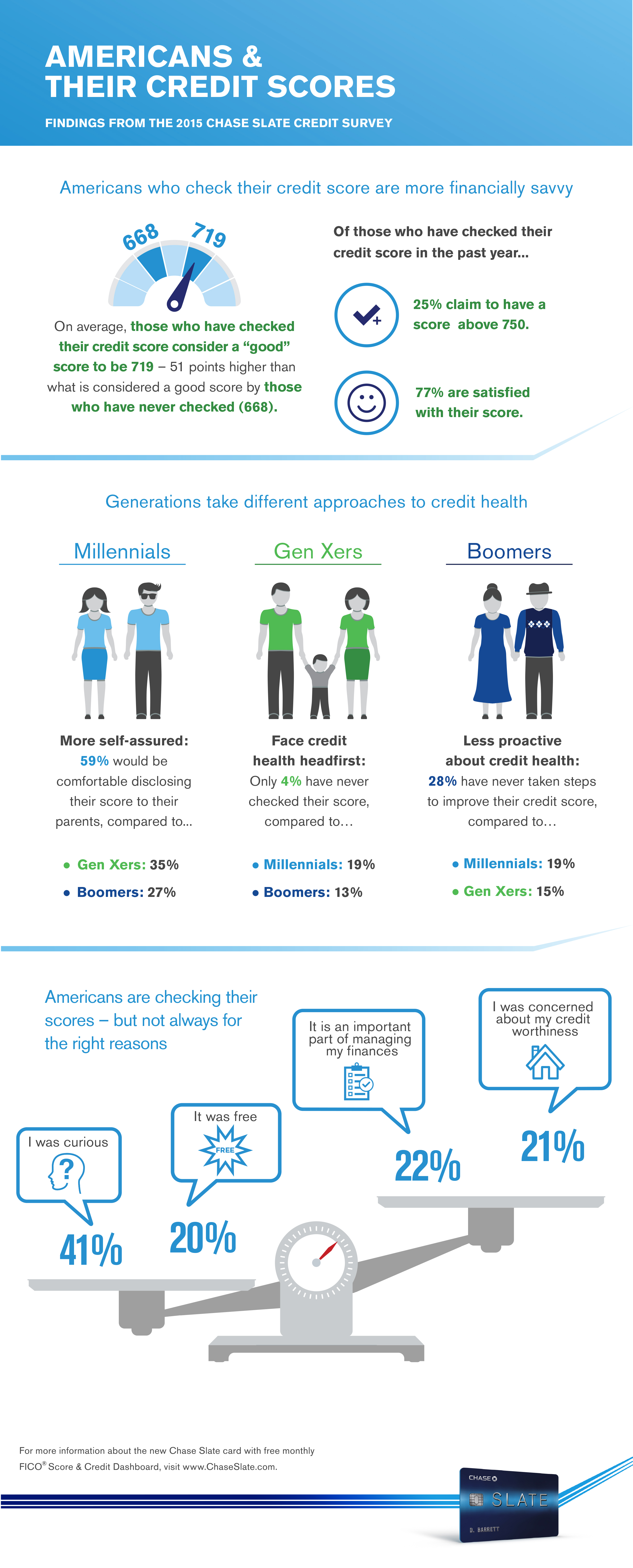

Millennials, ages 18 to 34, are the most confident generation about their credit status, with nearly three in five Millennials saying they would be comfortable disclosing their credit score to their parents, compared to only 35% of Generation X, according to the new Chase Slate Credit Survey.

The survey looks at different generational views on credit scoring. The survey found that while the vast majority of Americans (90%), recognize the importance that access to credit plays throughout their life, when it comes to awareness of their personal credit health there are gaps.

Although Millennials may be the most confident, they have a different view of what a good credit score is compared to their predecessors. Baby Boomers consider a good score on average to be 726, higher than Gen X (712) and Millennials (695).

Nearly four-in-ten Americans (39%) admit they do not know their current credit score, and more than half (52%) do not know that paying bills on time is the factor that has the largest impact on their credit score.

However, Gen X-ers, ages 35 to 49, know the most about their credit scores. Just 4% of Gen-Xers say they have never checked their score, compared to 19% of Millennials and 13% of Boomers.

Additionally, a majority of Gen X-ers (67%) claim they know their score, trailed by 60% of boomers and 55% of Millennials.

As for why, the survey suggests that hindsight has something to do with it. More than 62% of Gen X-ers claim they would have benefitted from knowing their credit score at some point in their lives.

Click to enlarge

Source: Chase