For the third time this year, WinWater Home Mortgage is preparing to bring a prime jumbo residential mortgage-backed securitization to market.

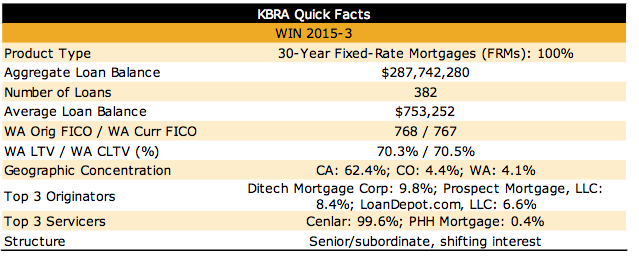

WinWater Mortgage Loan Trust 2015-3 is backed by 382 loans with a total principal balance of $ 287,742,280. The loans carry an average balance of $753,252, a weighted average original FICO score of 768 and a weighted average loan-to-value ratio of 70.3%.

WinWater, which refers to itself as “a residential mortgage conduit aggregator focused on opportunities in the non-agency jumbo sector,” brought three securitizations to market in 2014 after launching its first in June.

Now, just three months in to 2015, WinWater is already bringing its third RMBS of the year to market.

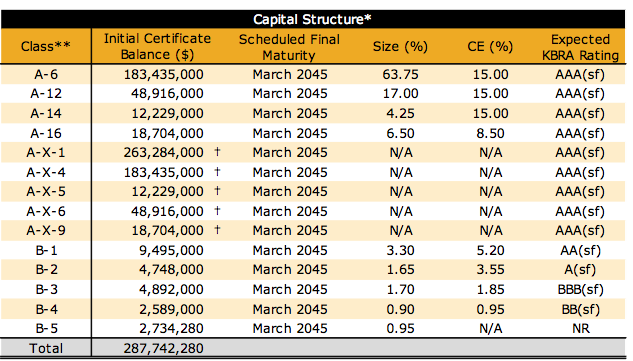

Kroll Bond Rating Agency weighed in on the offering and awarded AAA ratings to the largest of WIN 2015-3’s tranches.

According to KBRA’s report, the characteristics of the offering are very similar to WinWater’s previous offerings.

“The WIN 2015-3 collateral pool consists of high quality, prime mortgage loans that exhibit significant borrower equity. The pool’s 70.3% weighted average loan-to-value ratio and 70.5% WA combined LTV provide a margin of safety against potential home price declines,” KBRA writes in its presale.

“The CLTV ratio incorporates 2.0% of the borrowers possessing known subordinate financing,” KBRA continues. “There are no loans in the WIN 2015-3 collateral pool with a CLTV that is greater than 80%, and there are 130 loans (32.6%) with CLTVs equal to 80%.”

Additionally, KBRA notes the strong collateral quality of WIN 2015-3. According to KBRA’s report, the WA annual income and liquid reserves are $341,763 and $376,703, respectively, and most loans bear prudent debt-to-income ratios with a WA DTI of 32.8%.

Additionally, income, employment and assets for the pool’s borrowers were generally well-documented and verified, KBRA added.

Click the image below to see a breakdown of the offering’s characteristics.

Interesting to note among the loan originators in WIN 2015-3 is Ditech Mortgage Corp., which returned to the market in May and is the top originator in the WIN 2015-3 mortgage pool.

The new ditech was formed from the assets from the GMACRescap estate, purchased by Walter Investment Management Corp. (WAC)/Greentree Originations in November 2012.

According to KBRA’s report, ditech originated 9.8% of the loans in WIN 2015-3.

Additionally, Prospect Mortgage (8.4%); LoanDepot.com (6.6%); Skyline Financial (6.1%); and Stonegate Mortgage Corp (5.5%) are the originators that top 5% of the pool.

As with WinWater’s previous offerings, the largest section of the loans in WIN 2015-3 is located in California. Prior to this offering, the percentage of California-based loans had fallen with each WinWater offering. In WIN 2014-1, 64.7% of the loans were from California. In WIN 2014-2, 63.2% of the loans were from California. In WIN 2014-3, 49.2% of the loans were from California.

But in WIN 2015-3, 62.4% of the loans are from California.

According to KBRA's report, 21.4% of the loans are located in Los Angeles, 11.6% are located in San Francisco and 8.8% are located in San Diego.

Click the image below to see KBRA’s presale ratings.