Despite rising rents, investors still prefer fixing and flipping houses as opposed to buying a house for the purpose of renting it out, according a new report from Auction.com.

The results come courtesy of Auction.com’s February 2015 Real Estate Investor Activity Report, a nationwide survey of real estate investors bidding on properties offered for auction during the period.

According to Auction.com’s survey, 57.3% of respondents who identified as full-time “real estate investors” are looking to flip a property, compared to 41.5% that are buying to rent.

On the other hand, survey respondents who said that they were just making a “one-time purchase” were much more likely to be buying to rent (64.5%) than buying to flip (34.6%).

“It’s interesting that so many investors continue to focus on flipping as opposed to buying properties to meet rental demand, even as rents continue to increase and home ownership levels are at their lowest point in over a decade,” said Auction.com Executive Vice President Rick Sharga.

“Flipping is especially strong in states like California, where home prices are too high for most investors to easily rent out a home at a profit,” Sharga continued. “And there’s an immediate opportunity for flippers to profit in states where there’s simply not enough inventory of new and existing homes for sale to meet market demand.”

Interestingly, investors surveyed at live auctions were much more interested in flipping than those buying during an online auction.

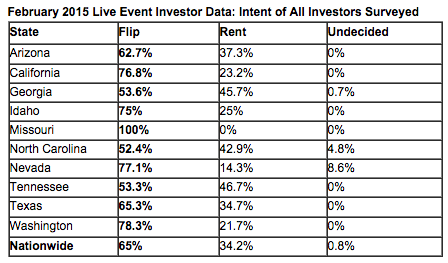

According to Auction.com’s data, 65% of the investors at live auctions were looking to flip the property, with Missouri, Washington, Nevada and California representing the states with the highest percentage of flippers.

Click the image below to see a look at a breakdown by state of flipping versus renting for live auctions.

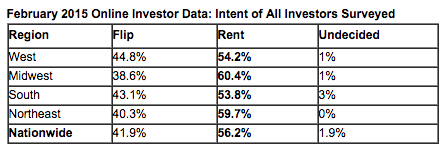

For online auctions, buyers intending to flip checked in at 41.9%, while 56.2% were investing to rent.

“Responses given at online auctions in February continued to show that investors bidding online are more likely to hold the properties they purchase,” Auction.com said in the report. “This was true even in the West and Northeast, the regions most likely to buck the renting trend due to higher purchase prices negatively impacting rental property returns.”

Click the image below to see a look at a regional breakdown of investor intent for online auction participants.

“As employment improves, it’s likely that the increasing cost of renting will incentivize more millennials to consider buying their first homes, which is good news for investors who are able to efficiently buy, rehab and sell properties in markets where inventory for entry level buyers is tight,” Sharga added.

“But the demand might not be immediate,” Sharga continued. “While increasing rents should be a stimulus to buy, the irony is that these rent hikes are also making it more difficult for potential buyers to set aside the money they need for down payments and making it harder for recent graduates to pay down student loans, which impacts their ability to qualify for a mortgage.”