Wow. Credit where credit is due.

Anyone need to know everything about millennials, homebuying, and their spending profiles?

Oh, but you only have less than 60 seconds?

Head to this hugely educational, animated graph on the Goldman Sachs (GS) website.

It’s full of helpful tidbits. For example, did you know millennials are the biggest generation in America, ever?

Here’s what the Wall Street investment bank writes about the low-earning, highly indebted generation proclivity to homebuying:

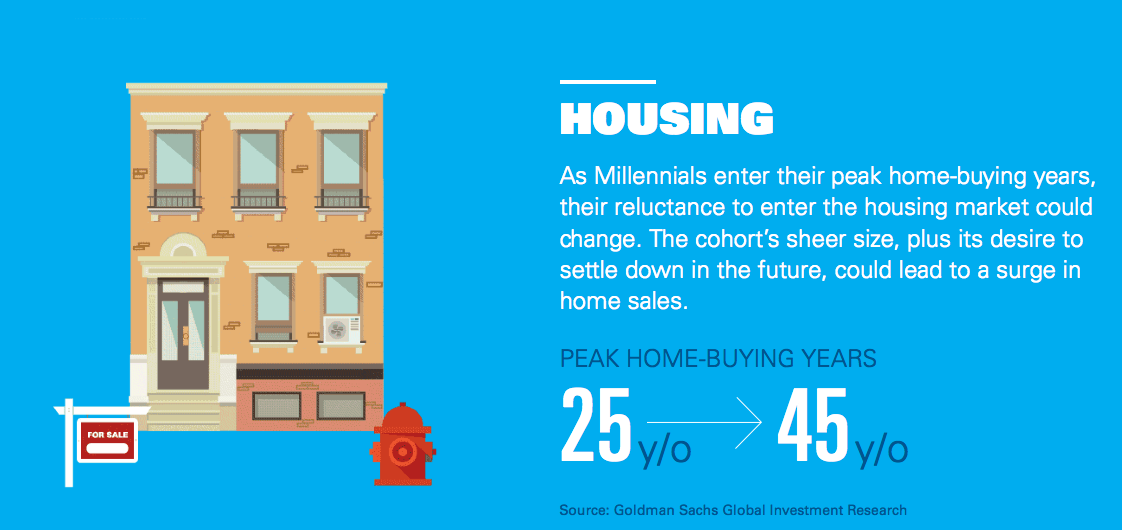

“As millennials enter their peak home-buying years, their reluctance to enter the housing market could change. The cohort’s sheer size, plus its desire to settle down in the future, could lead to a surge in home sales.”

Goldman may not seem the most-obvious place for digging for first-time homebuyers, but that’s not giving their initiatives, like this one, enough credit. And the bank is not stopping there, read on for more information.

First, here is that millenial homebuying info, displayed neatly (clicking below will take you to the graph on Goldman's website):

In fact, HousingWire reporter Brena Swanson is now on her way, Winter Storm Thor willing, to an exclusive Goldman Sachs Housing Finance Conference in New York City.

Speakers include the co-head of the investment bank division of Goldman itself, along with mortgage banking representatives from Loandepot, PennyMac and Wells Fargo. Our friend Mel Watt, the director of the Federal Housing Finance Agency will also pop round to deliver the luncheon keynote.

She’ll deliver some coverage for HousingWire.com readers tomorrow, so watch this space.