It is too soon to see the impact of the Federal Housing Finance Agency’s 3% down mortgage offerings.

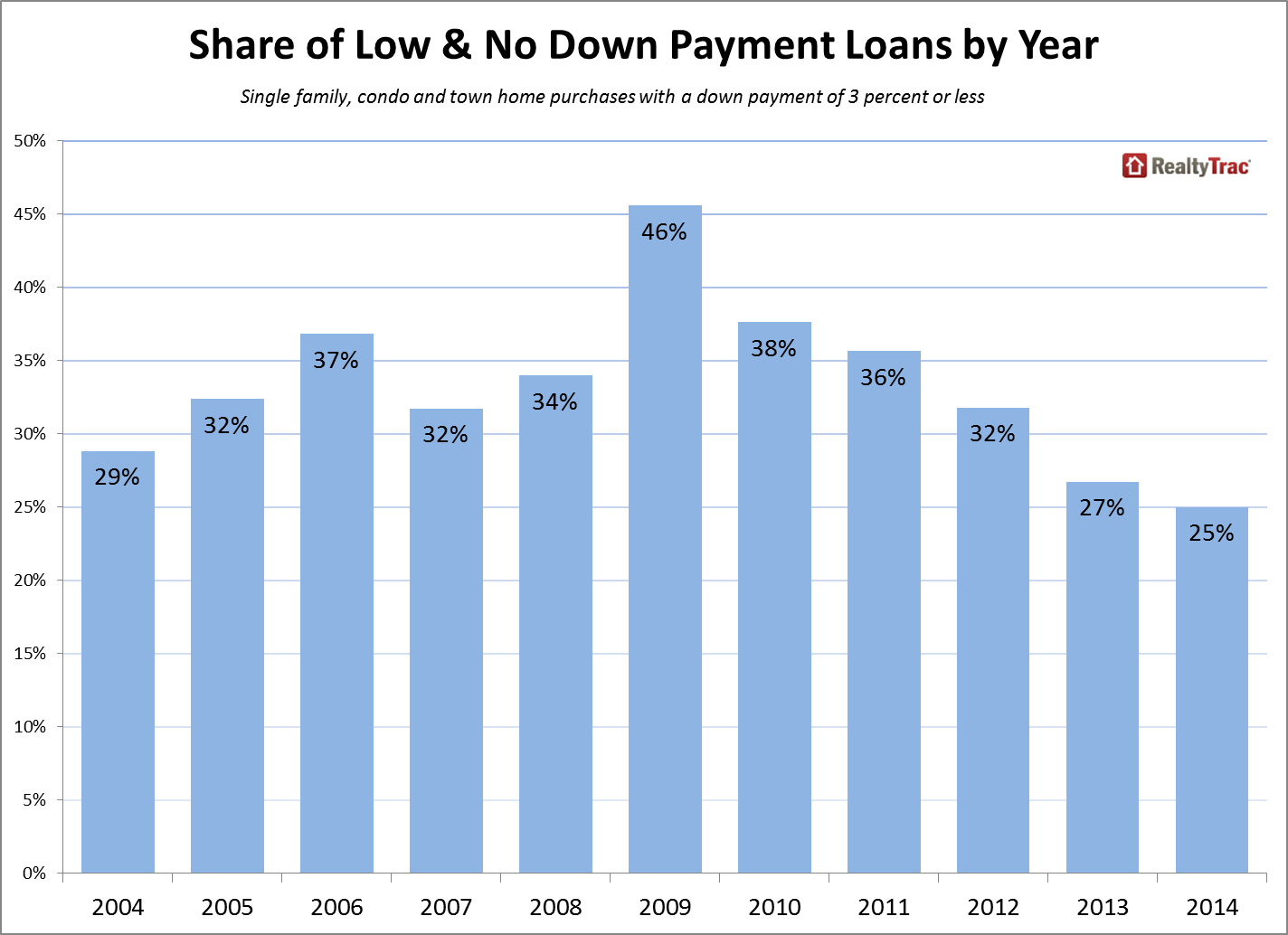

But as the market currently stands, the share of buyers using other low down payment loans has dropped to an 11-year low in 2014, a new report from RealtyTrac revealed.

In 2014, 25% of buyers using conventional or Federal Housing Administration loans put less than 3% down when purchasing a home, down from 27% in 2013 and down from a peak of 46% in 2009, when a first-time homebuyer tax credit stimulated purchases by first-time homebuyers, who are more likely to utilize low down payment loans. Since 2009 the share of buyers using low down payments has dropped every year compared to the previous year.

Click to enlarge

Source RealtyTrac

“The industry still has to adjust to the Fannie Mae and Freddie Mac products, and time will tell where it stands,” said Daren Blomquist, vice president at RealtyTrac.

Both government-sponsored enterprises announced their individual 97% loan-to-value products in December in an effort to expand the credit box to first-time homebuyers.

Fannie’s product is available now, and Freddie is slated to launch on March 23. In an interview HousingWire Thursday, Donald Layton, the chief executive of Freddie Mac, is feeling positive about the new 3% down payment mortgage option the government-sponsored enterprise is launching next month.

However, while the product does open the credit box, it does not mean is will push open the door unqualified borrowers, instead, it’s the opposite. Layton explained that the expectation is for responsible, stable lending to extra-worthy borrowers to utilize the product.

Fast forward to 1:30 to see a loan officer’s view on how the product offerings are faring.

Meanwhile, the Federal Housing Administration’s decision to reduce annual mortgage insurance premiums by 50 basis points, from 1.35% to 0.85%, has a lot more of an immediate reaction in the market.

“The FHA will have more of an immediate shot in the arm. It is a straight cut of a known product,” Blomquist said.

However, Blomquist noted that although there is not a lot of data now on the new FHFA products, this will give a basis point for when more research comes in.