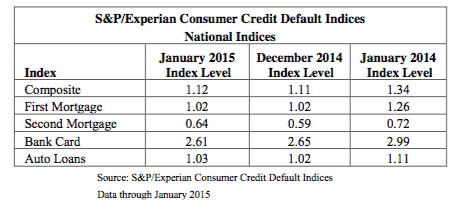

The first mortgage default rate finally remained stagnant in January after increasing for five months straight, continuing an upward trend in default rates from recent lows seen last year, the latestS&P/Experian Consumer Credit Default Indices report said.

In January, the first mortgage default rate stayed flat at 1.02% but is 14 basis points above the July 2014 low. The second mortgage default increased by five basis points to 0.64%, but is down from January 2014’s 0.72%.

As a whole, the national composite increased again, marking the sixth month of consecutive increases. The rate ticked up to 1.12% in January, up one basis point from December 2014 and up 11 basis points since its low in July 2014.

The auto loan default rate increased from 1.02% in December to 1.03%.

Only the bank card default rate decreased, moving down four basis points to 2.61%.

Click to enlarge

Source: S&P/Experian

“Numerous indicators point to more confident consumers who are more willing to spend and spend with credit. Consumer credit data from the Federal Reserve confirm growth in credit outstanding through the end of 2014,” the report stated. The results of the New York Fed’s Survey of Consumer Expectations shows consumers anticipate increased incomes and rising spending plans.”

But the recent improvements in the economy could be threatened by higher interest rates or a rebound in oil and gas prices.

A recent article in the Washington Post said that the days of plummeting gas prices may be over. After 100 days of declining prices at the pump, the cost of gas is finally expected to increase.

“However, for the moment the economy is justifying consumers’ upbeat outlook,” the report stated.

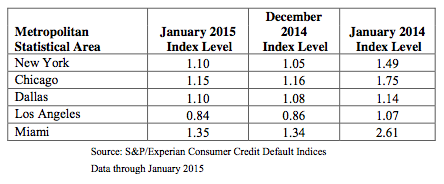

Looking across the nation at the five major cities, there was some variation in regional patterns.

Los Angeles or Dallas usually exhibit the lowest default rates, Miami is the highest over the last few years.

Instead, New York, Dallas and Miami reported default rate increases in January.

New York reported the largest increase for the second consecutive month, up five basis points, to 1.10%, while Los Angeles reported the largest rate decrease, down two basis points to 0.84%.

Click to enlarge

Source: S&P/Experian