Mortgage fraud maintained its decline at the end of 2014, falling 2% from the last quarter and 9% from one year ago, according to Interthinx’s quarterly interactive Mortgage Fraud Risk Report, covering data collected in the third quarter of 2014.

The national Property Valuation Fraud Risk Index decreased to 122, down 5% from last quarter and up 20% from a year ago.

Seven of the top 10 Metropolitan Statistical Areas for Property Valuation Fraud Risk this quarter are in Florida, including four of the top five spots.

Fort Walton Beach-Crestview-Destin remains the riskiest MSA for Property Valuation Fraud Risk this quarter, with an index of 215, although down 11% from a year ago.

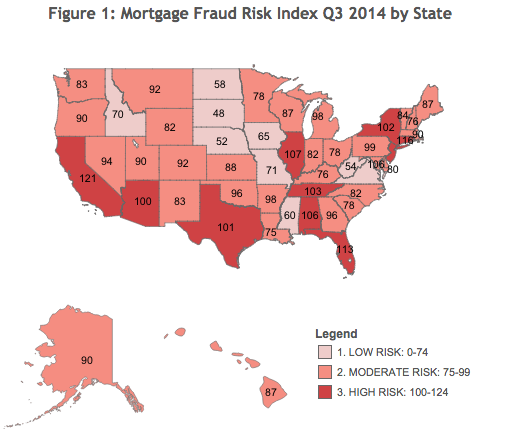

California is once again the riskiest state with a Mortgage Fraud Risk Index of 128, despite a 12 percent drop in overall risk, while Florida and New Jersey are tied at number two, each with an index of 122.

“Housing price pressure and home affordability can closely correlate with fraud risk,” said Jeff Moyer, president of Interthinx. “Analysis of our indices has shown that higher fraud risk is associated with markets that have lower affordability metrics.”

“When first time or lower income homebuyers face challenges during the qualification of credit, it can open the door to potential risk factors. Conversely, in the most affordable markets — where median income exceeds monthly housing expense, deposits are stronger, and consumer debts are lower, there is less likelihood to misrepresent income and our indices show comparatively lower fraud risk,” Moyer continued.

Click to enlarge

Source: Interthinx