Lending standards barely eased, if changed at all, for large and small banks, according to the October 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices.

The Federal Reserve survey looked at the responses from 76 domestic banks and 22 U.S. branches and agencies of foreign banks.

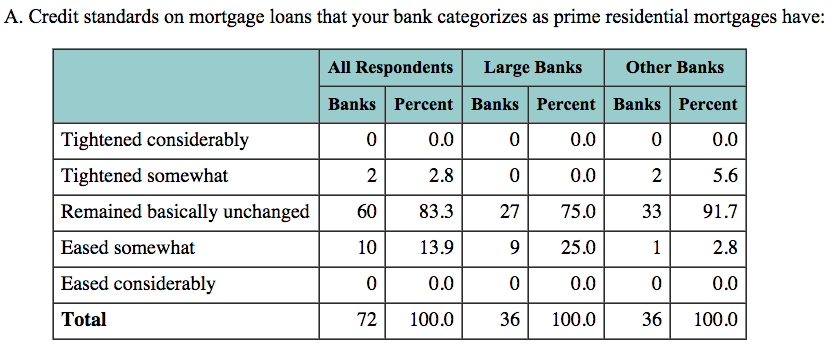

While a moderate net fraction of large banks reported that they had eased standards on prime residential mortgages over the past three months, smaller banks reported that standards for prime residential mortgages were about unchanged on net.

Click to enlarge

Source: Federal Reserve

Credit standards witnessed little change for nontraditional residential mortgages and subprime residential mortgages, at least for the few banks that chose to respond.

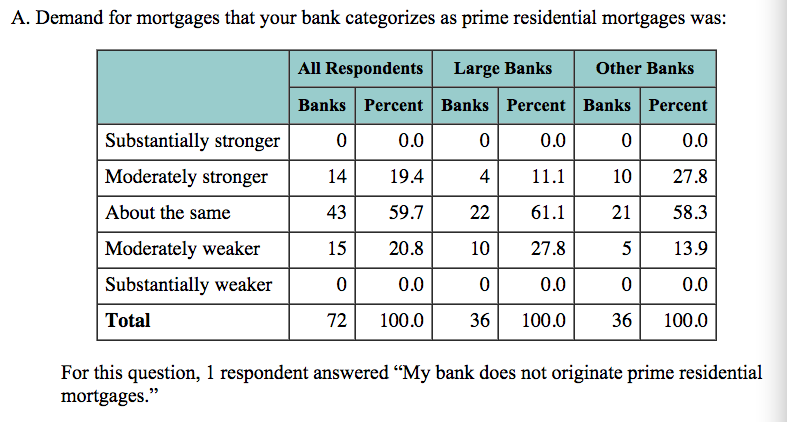

Demand for mortgage loans produced mixed results based on the banks. Although large banks reported that demand for prime mortgages had weakened, smaller banks experienced increases.

Click to enlarge

Source: Federal Reserve

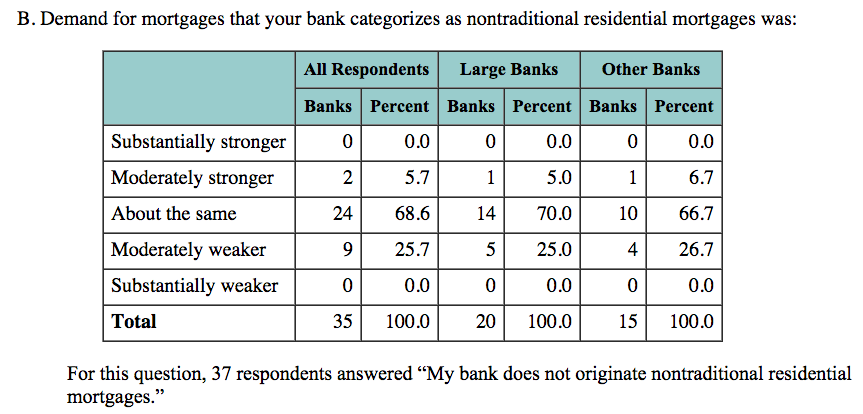

Meanwhile, demand for nontraditional mortgages was weaker, on net, across both bank size groups.

Click to enlarge

Source: Federal Reserve

Looking back at mortgage applications last year, in September, applications significantly dropped around the Labor Day holiday. However, it did recover heading into october when this survey ended.