The results of the latest Gallup poll show that the average American is still fretting over finances.

Let’s be honest, that will never change.

But what Americans fret over, financially, does.

Right now, more Americans are concerned about healthcare cost, low wages and a lack of jobs.

When it comes to the capital markets, they worry about the cost of college for their children.

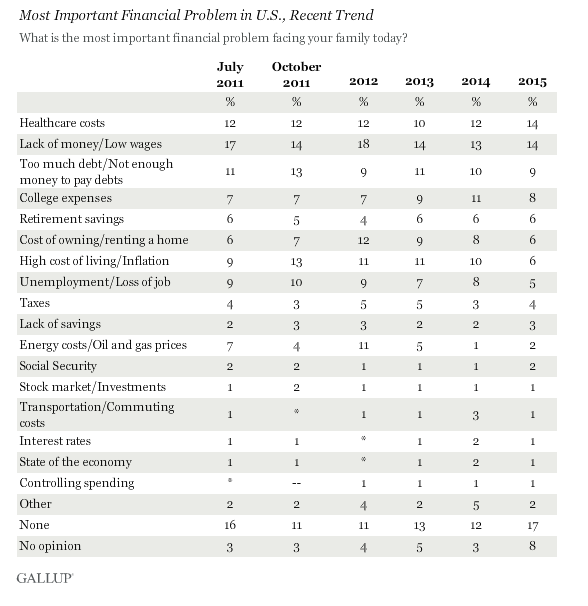

But, to us, the most striking result of the Gallup poll, explained in the chart below, is the shift in the attitude towards owning a home.

In just three short years, the number of Americans who cite the costs associated with homeownership and renting as one of their biggest financial worries, sliced firmly in half.

In 2012, a full 12% of Americans put this cost at the top of their financial worry. Now it’s down to 6%.

Although when broken down by income, the results skew somewhat.

Below the $30k/year bracket, housing is the most important worry for 9% of the respondents. That lowers to 4% in the $30k to $75k range. But then, it jumps up to 6% for Americans making more than that.

Click here for the full report.

“Perhaps not surprisingly, lower-income Americans name "lack of money/cash flow" and "not enough money to pay debts" as their top most important money woes,” Gallup said.

“The stock market or investments, interest rates, retirement savings and controlling spending do not rank among lower-income Americans' top financial problems.”

Here’s how the woes break down (click to enlarge):