Congress reduced the maximum size of mortgages guaranteed by the Veterans Administration in order to match the standards of Fannie Mae and Freddie Mac, a report from the Urban Institute said.

Starting Jan. 1, 2015, the VA loan limits will match the government-sponsored enterprises, with a $625,500 maximum loan for single-family homes in the lower 48 states.

Currently, the VA is authorized to guarantee loans of more than $1 million in some high-cost counties of California and Massachusetts, and up to $978,750 in New York City.

But despite the drastic reduction in some areas, the Urban Institute argued that this does not mean the loss of credit access for large numbers of veterans.

In most areas with a large reduction, VA loans made up a very small percentage of total new mortgages, with relatively few of the VA loans created over the new limit.

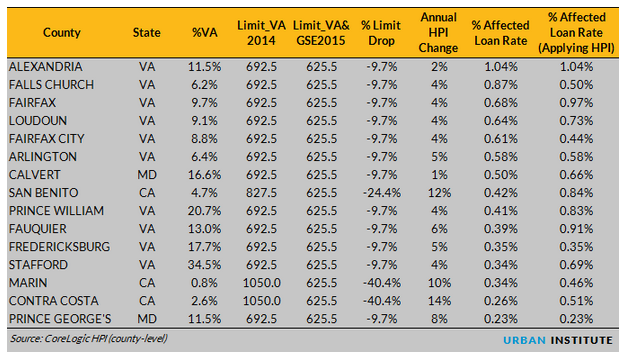

This table shows the 15 most affected areas, measured by the percent of affected borrowers.

Click to enlarge

Source: Urban Institute