Anyone following the public discourse about the mortgage market knows that lending is overly tight right now. And those who follow the issue closely understand that a primary driver of this tightness is uncertainty over how Fannie Mae, Freddie Mac and the Federal Housing Administration enforce their underwriting rules. What most do not realize is that that there is another major driver: the increasingly high cost of servicing delinquent loans. Our new report explains how this high and often difficult-to-control cost is driving lenders to apply credit overlays, particularly in their FHA lending.

Tiny share of loans, enormous share of costs

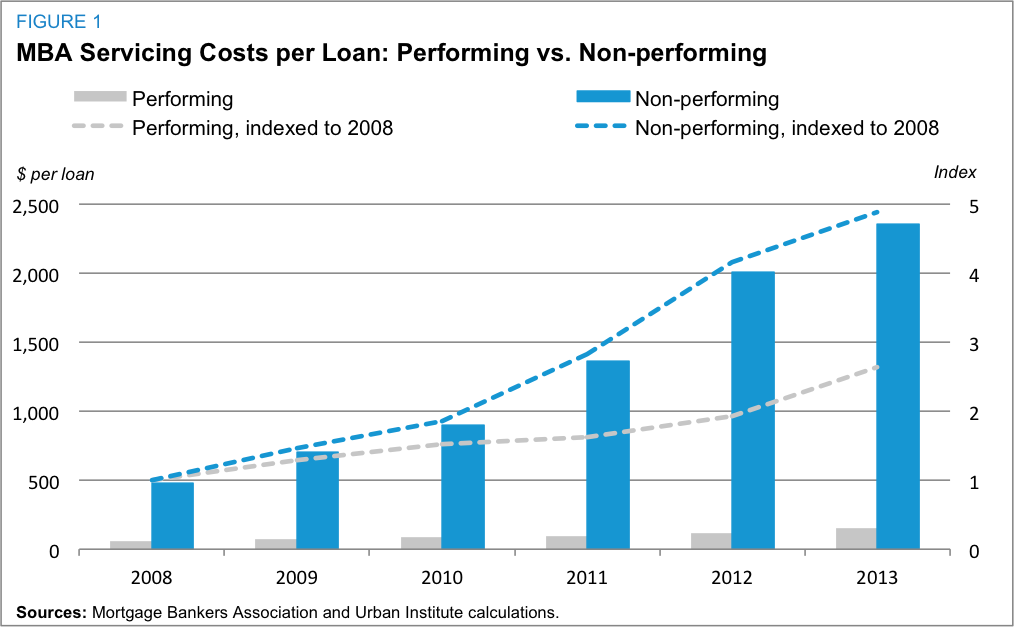

With the economy in better shape and home prices continuing to improve, fewer homeowners are delinquent on their mortgage payments. Less than 7% of the sample in a Mortgage Bankers Association (MBA) analysis were 30 days or more behind on payments or in foreclosure. Yet servicing that small fraction of loans captured more than half of the lenders’ servicing costs.

According to the MBA, as of 2013, servicing a non-performing loan cost an average of $2,357 per year, compared to just $156 for a performing loan — a 15-fold difference. Moreover, there is a large variation in servicing costs across delinquent loans, and new servicing rules make cost estimation even more uncertain. As a result, lenders are more apt to place overlays at the point of origination to reduce the number of loans they make that are likely to become seriously delinquent. This means fewer loans are being made to borrowers with less than pristine credit, notwithstanding the willingness of the GSEs and FHA to accept such loans.

According to the MBA, as of 2013, servicing a non-performing loan cost an average of $2,357 per year, compared to just $156 for a performing loan — a 15-fold difference. Moreover, there is a large variation in servicing costs across delinquent loans, and new servicing rules make cost estimation even more uncertain. As a result, lenders are more apt to place overlays at the point of origination to reduce the number of loans they make that are likely to become seriously delinquent. This means fewer loans are being made to borrowers with less than pristine credit, notwithstanding the willingness of the GSEs and FHA to accept such loans.

Timelines and high fees a challenge

The GSEs and FHA, which ultimately bear the credit risk of the delinquent loans they purchase or service, expect loan servicers to start and complete the foreclosure process on non-performing loans within a timeframe that minimizes losses. Yet these timelines are often difficult if not impossible to meet while meeting consumer protection rules put in place by states and the Consumer Financial Protection Bureau (CFPB). The GSEs have recently taken steps to extend their timelines, which should result in reduced fees per loan, as “compensatory fees” are incurred based on the number of days the timeline is exceeded. The GSEs and FHFA are doing a further re-evaluation of their timelines in several areas where there have been few liquidations. The fee threshold was also raised, eliminating the fees for many smaller servicers. Even so nearly 40% of loans from larger lenders will still be subject to some charges.

The problem is more acute in servicing FHA loans, which has more challenging timelines and greater fees. As an example, FHA penalizes servicers if they do not initiate foreclosure actions within 180 days of default (“the first legal action date”). Yet consumer protection provisions put into place by the CFPB do not allow for a foreclosure filing until the borrower is more than 120 days delinquent. This makes it almost impossible to meet that deadline when the borrower submits a modification application close to the CFPB’s 120-day deadline, then appeals the result. Both the GSEs and FHA have appeal processes when the fees are incurred due to circumstances beyond the servicer’s control, but the processes are loan-by-loan, cumbersome, and have an uncertain outcome. In addition, FHA servicers are likely to incur substantial unreimbursable expenses due to inflexible guidelines on property preservation and conveyance.

A drag on the housing market

There are promising signs of a pick-up in the mortgage and housing market recovery for the coming year. Interest rates are low and affordability remains strong by historical standards, and economists are projecting increases in home construction. But tight credit threatens to stifle this improvement. The recent steps to address reps and warrants and facilitate low-downpayment lending are promising, but they are only part of the issue. Policymakers must turn to servicing costs next to remove a major obstacle to the housing market recovery.