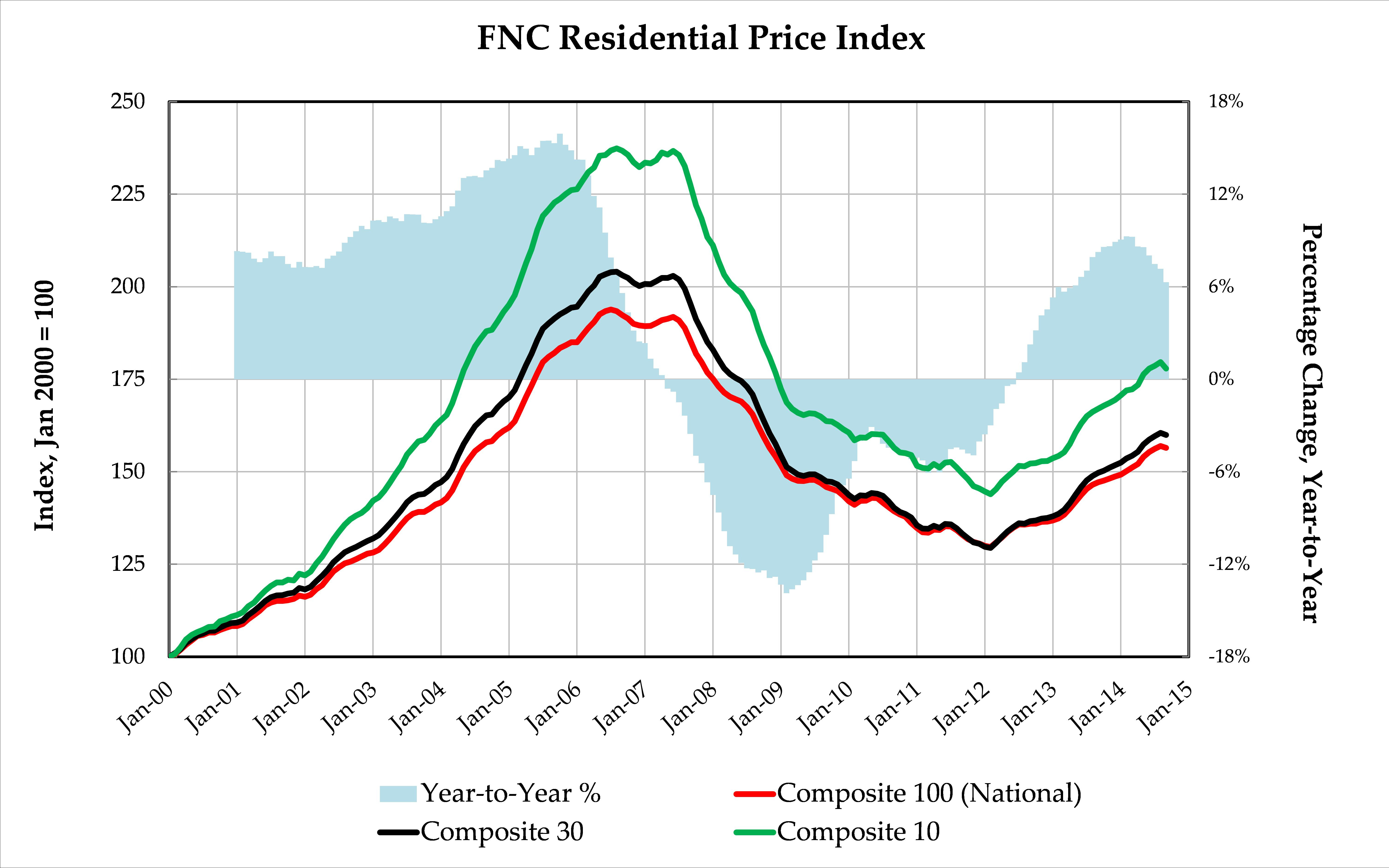

Home prices finally reversed a 30-month rising streak and declined in September despite strong home sales and continued labor-market improvement, the latest FNC Residential Price Index said.

The index is based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas and decreased 0.3% between August and September.

Click to enlarge

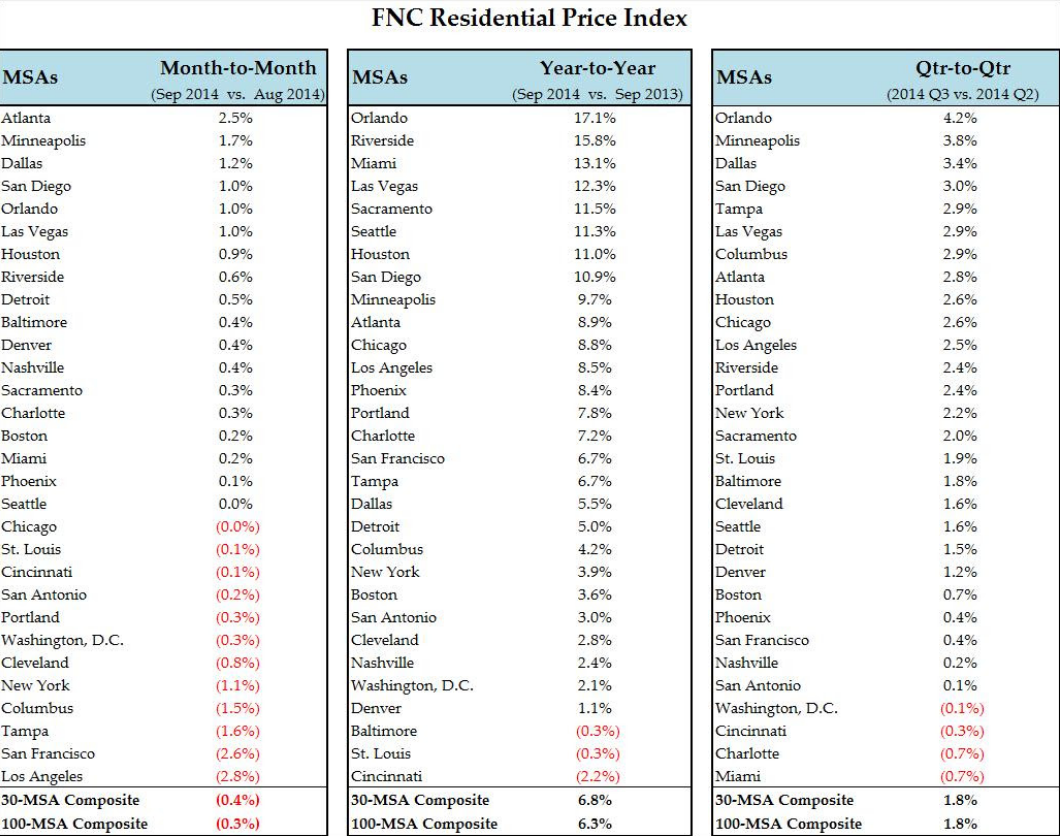

In addition, the annual rate of home price appreciation continued to level off and fell to 6.3% in September. Throughout the third quarter, home prices were up 1.8% from the second quarter.

Completed foreclosures comprise about 11.5% of total existing home sales, up slightly from the summer months. Meanwhile, an expected increase in the pace of disposing distressed properties this winter could further dampen home prices.

The average asking price discount and time-on-market have continued to steadily rise over the past four months, with the median discount at 3.5% and the TOM at 99 days in October.

The largest prices declined occurred in the nation’s top housing markets, led by San Francisco and Los Angeles.

Click to enlarge

Source: FNC