After almost 16 years of absolutely no changes, the S&P Dow Jones Indices announced it is updating its select sector indices to accommodate a new and growing asset class: the real estate sector.

The need for a separate real estate sector was decided following the company’s annual review of the Global Industry Classification Standard structure, bringing the official count of GICS sectors to 11.

According to the company, “The S&P 500 focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also represents the market. Companies in the S&P 500 are considered leading companies in leading industries.”

The original 10 select sectors launched on Dec. 16, 1998, and consist of: consumer discretionary, consumer staples, energy, financials, health care, industrials, materials, technology (combination of information technology sector and telecommunication services sector) and utilities.

With these changes, real estate, which falls under the financials sector, will be promoted to its own sector under the code 60.

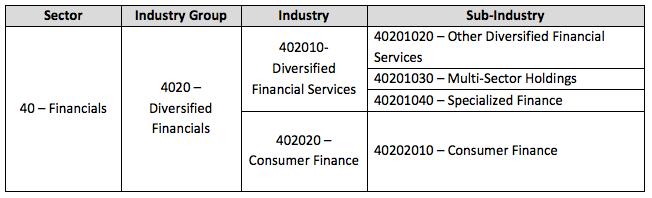

(Source S&P: Click to enlarge)

“Feedback from the annual GICS structural review confirmed that real estate is now viewed as a distinct asset class and is increasingly being incorporated separately into the strategic asset allocation of asset owners,” said Remy Briand, managing director and global head of equity research at MSCI.

“Investors told us that there are significant differences between public real estate and financial companies and therefore real estate deserves a dedicated GICS sector,” he continued.

While the changes were announced late Monday, S&P Dow Jones Indices and MSCI are proposing to implement the changes to the GICS structure after the market close on Aug. 31, 2016. However, they are still requesting feedback from market participants on this proposed implementation date by Feb. 13, 2015.

From there, they will announce the final decision on the date of implementation by March 13, 2015.