It’s probably safe to say that Ocwen Financial (OCN) would like to forget the last few days.

It all started last Tuesday when New York Department of Financial Services Superintendent Benjamin Lawsky sent a letter to Ocwen, alleging that the company had backdated potentially hundreds of thousands of letters to borrowers “likely causing them significant harm.”

In the aftermath of Lawksy’s letter, ratings agencies, banks and other advisory services took turns knocking Ocwen for its business practices.

First, Moody's Investors Service, Bank of America (BAC) and Evercore Partners all issued downgrades to Ocwen’s ratings.

Then Compass Point downgraded Ocwen affiliate Home Loan Servicing Solutions from Buy to Neutral with a price target of $18 and Standard & Poor's Ratings Services lowered its long-term issuer credit rating to 'B' from 'B+' on Ocwen and said that the outlook for Ocwen is now negative.

Late last week, Barclays joined the chorus of negativity directed at Ocwen, telling clients that investors in non-agency residential mortgage-backed securitizations “should be more wary of a worst-case scenario,” when it comes to Ocwen.

Finally, Fitch Ratings sounded the alarm on Ocwen when it announced Friday that it was placing all the U.S. residential mortgage servicer ratings for Ocwen Loan Servicing on “Rating Watch Negative.”

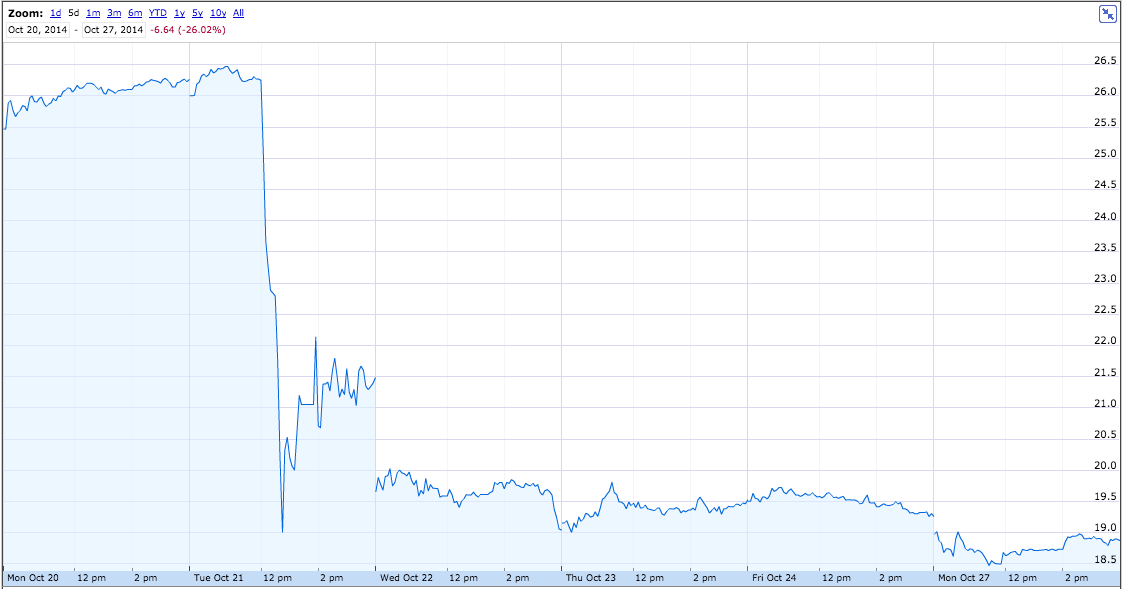

But if you want to know just how bad Ocwen’s week really was, all you need to do is look at one chart: Ocwen’s stock price.

Click the chart below to see the price Ocwen’s stock over the last week. Image courtesy of Google Finance.

See if you can spot when Lawksy’s letter was released.

Ocwen started out last week cruising along at around $26 per share. Then Lawsky’s letter happened.

When the letter came out at noon Eastern on Tuesday, the stock was trading at $26.25. Within 45 minutes, the stock had plummeted to $19.10 per share.

The stock rallied back that day to close at $21.48, before falling again at market open on Wednesday to $19.48.

Since then, the stock hasn’t been back above $20 per share.

On Monday, Ocwen finally responded to the allegedly aggrieved borrowers, saying in a letter from CEO Ron Faris:

“We apologize to all borrowers who received misdated letters. We believe that our backup checks and controls have prevented any borrowers from experiencing a foreclosure as a result of letter-dating errors. We will confirm this with rigorous testing and the verification of the independent firm. It is worth noting that under our current process, no borrower goes through a foreclosure without a thorough review of his or her loan file by a second set of eyes. We accept appeals for modification denials whenever we receive them and will not begin foreclosure proceedings or complete a foreclosure that is underway without first addressing the appeal.”

If Ocwen’s shareholders were hoping that Faris’ letter would immediately turn Ocwen’s nosedive around, they were left wanting.

Ocwen closed Monday at $18.88.

And for the year, Ocwen’s stock is down 66.52%.