Now that the majority of mortgage bank earnings are in, the results are nowhere close to last year’s record levels.

And while quarter-over-quarter, earnings were about flat, a report from Keefe, Bruyette and Woods said, “Given the ongoing shift in mortgage origination market share from banks to non-banks, mortgage origination trends could be even stronger for the non-bank mortgage originators.”

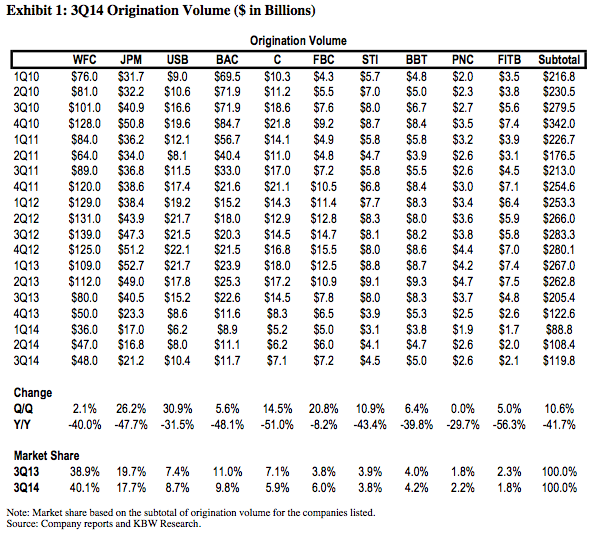

Of the banks that they follow, total originations were up 11% from the second quarter, but down by 42% from the same period last year. Mortgage applications were down going into the fourth quarter.

(Source KBW: click for larger image)

Here are the results of the top three banks:

- Wells Fargo (WFC) reported net income of $5.7 billion, or $1.02 per diluted common share, for third quarter 2014, up from $5.6 billion, or $0.99 per share, for third quarter 2013. The bank’s mortgage unit suffered a profit decline of 46% over the past quarter and its new origination mortgages fell to its lowest level since the financial crisis.

- JPMorgan Chase (JPM) posted a third-quarter profit after a year-earlier loss, while setting aside $1 billion for legal expenses. Mortgage banking net income was $439 million, a decrease of $266 million from the prior year, driven by a lower benefit from the provision for credit losses, largely offset by lower noninterest expense.

- Bank of America (BAC) beat analyst expectations, reporting net income of $168 million for the third quarter of 2014, on top of shrinking revenues driven by a decline in originations and mortgage servicing rights, among other factors. The company originated $11.7 billion in first-lien residential mortgage loans and $3.2 billion in home equity loans in the third quarter of 2014, compared to $11.1 billion and $2.6 billion, respectively, in the second quarter of 2014, and $22.6 billion and $1.8 billion, respectively, in the year-ago quarter.

“We view the mortgage results for the banks that have already reported 3Q earnings as slightly above expectations, since most market observers expected about flat volumes going into earnings,” the report said.

Looking ahead, the Mortgage Bankers Association is forecasting a 7% increase in mortgage originations in 2015, to $1.19 trillion, with purchase originations rising 15% to $731 billion in 2015, and refinance originations decreasing 3% to $457 billion.

“We are projecting that home purchase originations will increase in 2015 as the U.S. economy continues on its current path of stronger growth, job gains and declining unemployment,” said Michael Fratantoni, chief economist at the MBA.

“The job market has shown sustained improvement this year; with robust monthly increases in both payroll jobs and job openings. We are forecasting that strong job growth, coupled with still low mortgage rates, should translate to an increase in home sales and purchase originations,” he added.