Invitation Homes is preparing to bring its third REO-to-rental securitization of the year to market soon. The securitization, Invitation Homes 2014-SFR3, will be collateralized by a $775.1 million loan secured by first priority mortgages on 4,048 income-producing single-family homes.

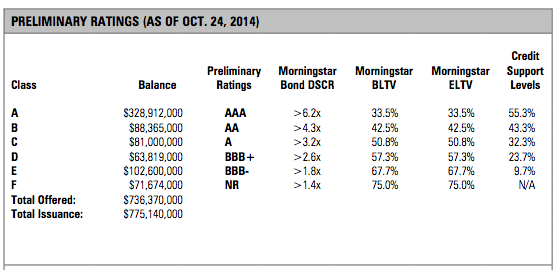

Both Morningstar andKroll Bond Ratings Agency released presale reports for the in on the securitization, with each awarding $328.91 million in AAA ratings to the offering's Class A tranche.

This will be Invitation Homes’ third single-family rental securitization of 2014, and its fourth overall.

Its previous offering, Invitation Homes 2014-SFR2, was collateralized by a single $720 million loan secured by the mortgages of 3,750 single-family rental properties.

That offering received $322.58 million in AAA ratings from Morningstar.

Invitation Homes’ two previous REO-to-rental securitizations received positive reports on the vacancy rates of the underlying properties earlier this year, but that came on the heels of the vacancies surging in Invitation Homes’ largest securitization to date, which nearly exceeded $1 billion.

Considering the nature of renters, the level of volatility is to be expected but it is still a potential cause for concern, according to Morningstar.

“Not all properties were leased as of the property cut-off date,” Morningstar said. “Vacancy at cut-off was 4.3% and the delinquency rate was 0.4% based on BPO value. All vacant properties have had previous Invitation Homes leases. Month-to-month leases account for 1.7% of the properties. Morningstar applies higher vacancy assumptions to account for these attributes.”

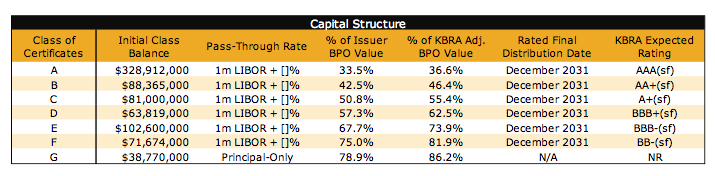

Click the image below for KBRA's presale ratings.

According to KBRA, the loan on the properties is a floating rate loan that will require interest-only payments and have a two-year initial term with three 12-month extension options.

The broker price opinion on the underlying properties varies from $40,000 to $950,000, and the properties carry an average BPO of $242,546. According to Morningstar’s data, the post-renovation cost basis range is $48,307 to $764,690.

The average rehab cost of the properties is $25,074.

The underlying properties are single-family homes and 2-4 unit residential properties located in 10 states, with the three largest state exposures representing 77.9% of the aggregate BPO value of the portfolio: California (37.1%), Florida (32.1%), and Arizona (8.8%), according to KBRA’s data.

The location of the homes is a concern for both agencies. “The properties are also concentrated in regions of the country that experienced high levels of mortgage defaults in recent years,” KBRA said.

“These regions subsequently experienced rapidly rising property values due to high investor demand for distressed properties. In KBRA’s view, there is a risk that these markets could cool off and prices could fall, particularly if supply increases rapidly due to investors ‘flipping’ properties or holders of distressed properties seek to exit their positions.”

Click the image below for Morningstar's presale ratings.

One interesting note is the size of the properties. According to KBRA’s data, IH 2014-SFR3 consists of underlying homes with an average size of 1,905 square feet, which is near the upper end of the range compared to the prior transactions. On average, the homes in the previous securitizations ranged in size from 1,698 square to 2,045 square feet, with an average of 1,866 square feet.

“The average size of the subject properties is viewed positively compared to the smaller sizes of the homes in many of the prior transactions,” KBRA said.

KBRA also questions the management of Invitation Homes, stating “The firm recently announced significant changes to its leadership structure by replacing the Chief Executive Officer and appointing a new Vice Chairman of the Board as well as a new Executive Chairman of the Board of Directors. While KBRA believes the new members of executive team have significant experience, the appointments create some uncertainty relating to the implementation of the company’s long-term strategy.”