Marriage is no longer at the forefront of Americans' minds as more people choose to delay it, creating a ripple effect that pushes the prospect of homeownership further back.

And since this industry is so closely tied to marriage, family and homeownership, housing is scrambling to figure out how to adjust for the changes.

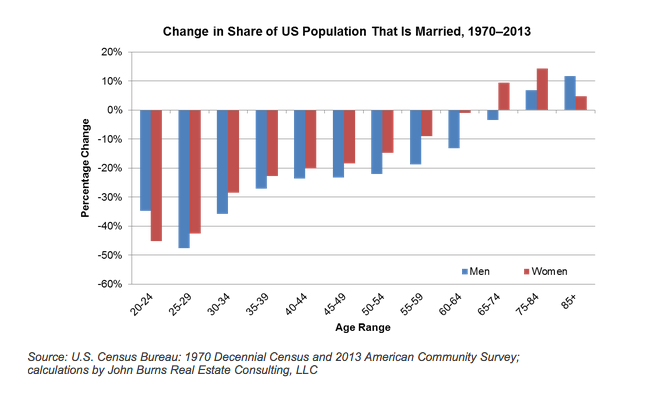

The share of 25- to 29-year-olds who are married has significantly plunged from the 1970s, down by 48% for men and 43% for women, Mollie Carmichael ,with John Burns Real Estate Consulting, said in a new report.

(Source: John Burns; click to enlarge)

As peoples’ preferences change, so do their housing needs and desires. Here are a few examples that Carmichael lists:

- “Marriage usually ignites the desire to own a home with a variety of locational and housing choices on income and family present.”

- “Cohabitation has certainly been on the rise in recent decades, but homeownership rates for cohabitating couples are much lower than rates for married couples.”

- “The addition of children makes owing a home almost a necessity, given the need for yards, toys, education and social circles.”