Affordability is no longer a compelling motivator for first-time homebuyers, according to a new report from Credit Suisse.

Due to the combination of higher mortgage insurance costs, higher interest rates and higher home prices, affordability is back to the long-term averages for first-time buyers.

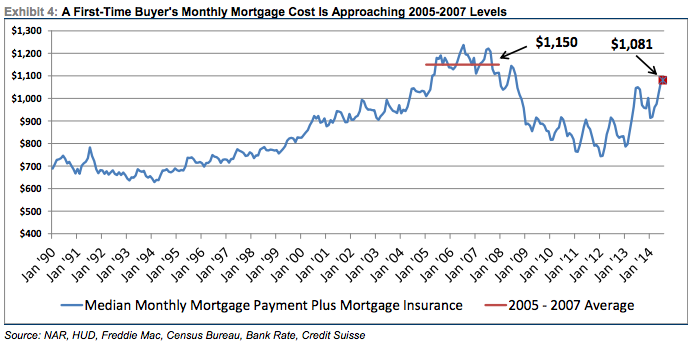

The median monthly mortgage payment of $1,081 is only 6% below the '05-'07 average of $1,150.

“As such, we see much less room for further home price appreciation absent more meaningful income growth or lower interest rates (the latter of which we see as particularly unlikely),” Credit Suisse said.

While mortgage interest rates have decreased, higher costs for FHA mortgage insurance and higher home prices have more than offset it, which has pushed the monthly cost of a first-time buyer's mortgage to levels that were last seen when home prices were peaking.

“We think this helps to explain why the segment has been largely absent from the recovery and why it will take time for demand to improve, absent faster income growth or lower home prices, particularly as rates rise,” Credit Suisse continued.

And according to a recent RealtyTrac report, one-third of counties surveyed have surpassed their historical averages for income-to-price home affordability percentages since 2000 — making residential properties less affordable now than they have been on average over the last 14 years.

“The scales are beginning to tip away from the extremely favorable affordability climate we’ve seen over the last two years, with one-third of the counties analyzed — representing 19 percent of the total population in those counties — now less affordable than their long-term averages,” said Daren Blomquist, vice president at RealtyTrac.

(Click to enlarge, source Credit Suisse)