The future for mortgage nonbank servicers looks tough as earnings for the sector are forecasted to trend down due to a variety of industry headwinds.

“While we continue to think the regulatory overhang on the industry will eventually be lifted, we still expect servicing acquisition activity to remain slow,” Keefe, Bruyette & Woods said in its latest report.

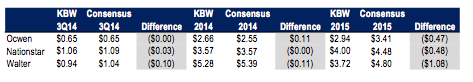

KBW attributed the downward trend of long-term earnings per share estimates for the servicers to three factors.

1) An increase in the percentage of newly created prime servicing, which should generate lower returns.

2) A reduction in ancillary fees such as Home Affordable Modification Program fees and late fees.

3) Reduction in mortgage banking income driven by the end of the Home Affordable Refinance Programs at the end of 2015.

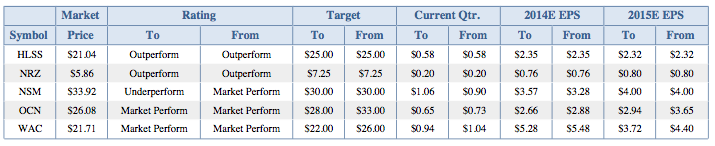

KBW also reduced its EPS estimates for Ocwen Financial Corporation (OCN) and Walter Investment Management (WAC), while downgrading its rating of Nationstar Mortgage Holdings (NSM) to underperform.

Ocwen’s price target was reduced to $28 from $33 and Walter’s was dropped to $22 from $26 as Nationstar maintained a $30 price target.

However, as a result, KBW is reducing its rating on Nationstar to underperform given the downside to its $30 target price.

“Our price target multiples are generally higher than what we typically use for mortgage banks. This reflects our expectation that the companies will continue to have a component of distressed servicing that will provide a stream of more steady fee income,” KBW said.

“While the servicers should have the ability to replace much their run-off through creating new mortgage servicing rights, we believe that prime servicing is a business with lower returns and so mortgage banks that are primarily servicers of prime assets generally trade at lower multiples of book value,” KBW continued.

Meanwhile, New Residential Investment (NRZ) and Home Loan Servicing (HLSS) ratings were reiterated as outperform since both companies are well positioned to maintain dividends into 2015.

“We believe that there is concern in the market about the ability of both companies to grow servicing assets given the slowdown in portfolio growth at their partner servicing companies (Nationstar for NRZ and Ocwen for HLSS),” KBW said. “As we noted earlier, we believe that servicing sales will continue, albeit a slower pace than in the past.”

Click to enlarge:

(source KBW)